2023 - Q3 Newsletter

FinTech Law & Joot

FinTech Law is an innovative, technology-driven law firm that provides legal and consulting services to startups, crypto-related and other technology companies, investment advisers, broker-dealers, private funds, registered funds, and other financial services companies.

Joot is a technology-driven compliance company that provides services to registered investment advisers and registered investment companies, such as mutual funds, closed-end funds, and ETFs. Joot’s clients include retail advisers, institutional managers, private fund managers, and mutual fund advisers.

For more information, please visit us online at fintechlegal.io and joot.io or contact us at info@fintechlegal.io.

Highlights

During the quarter ended September 30, 2023, U.S. Securities and Exchange Commission (SEC) had over 50 outstanding rule proposals! A huge number that caught the attention of the US Congress. For those involved in RIA Advocacy Day (sponsored by the Investment Adviser Association), it became clear that both Democrats and Republicans are unhappy with Chair Gensler’s activist agenda, especially its impact on small businesses. For the past few years, the industry has been chastising the SEC for its aggressive rulemaking and enforcement agenda. For the most part, the commission has ignored industry complaints. But registrants are now finding sympathetic audiences in the House and Senate. The SEC’s new fiscal year started on October 1, 2023, and we should get information on its activities when it issues its annual report later this year. Expect enforcement numbers and rule proposals to be near or above historic levels. For the fiscal year ended September 30, 2023, the SEC certainly did more with its resources than prior Commissions, as it pursued an aggressive rulemaking and enforcement agenda. For the current fiscal year, we’ve included a list of recently passed and proposed rules that impact funds and advisers.

AI in Asset Management

In August, Commissioner Hester Pierce criticized the SEC’s recent proposal to regulate the use of artificial intelligence technology and other machine learning tools that rely on predictive analytics. Commission Hester Pierce suggested that under Chair Gary Gensler’s watch, the SEC has moved away from its core disclosure-based principles. Since its founding in the 1930s, the SEC has taken the position that if investors are given adequate information, they should be left to make their own decisions. But the spate of SEC rule proposals during Gensler’s tenure suggests that he doesn’t’ believe in that fundamental principle. Rather, the SEC’s new position suggests that industry participants are barbarians at the gate who need to be kept in check by a mighty government force and its arsenal of proscriptive rules. Or as Commissioner Peirce stated, “[t]he release does seem to suggest that investors when confronted with these technologies just melt into puddles of incompetence and sol disclosure doesn’t work for them.”

If true, then the result will be a heavier regulatory burden on investment advisers, which will disproportionately harm the smaller advisers who make up 80% of the industry (by number of firms), but less than 20% of the assets. These smaller firms often have only 5-20 employees and no in-house technology expertise in areas of AI and ML. As a result, they will need to either outsource such reviews, which can be costly, or avoid using such technologies, which puts them at a competitive disadvantage to their larger peers who are heavy users of AI and ML, including Fidelity Investments, JPMorgan Chase & Co., Morgan Stanley, Vanguard, Deutsche Bank, ING. The current proposal against technology would make it harder for these firms to deploy scalable technology to investors, resulting in further consolidation of advisory services at the largest industry giants (e.g., Fidelity, Blackrock, Vanguard, etc.).

The SEC’s AI rule is partly in response to the continued growth of robo-advisers such as Betterment and Wealthfront and industry consolidation of both fintech at firms such as Charles Schwab and Robinhood and private equity backed companies like Orion. These firms already leverage AI at scale and have the necessary in-house expertise to manage such products. Smaller advisers, however, must outsource nearly all their technology needs because they lack the scale and capital to maintain teams of data scientists, project managers, and developers. No one doubts that AI and ML tools will have a substantial impact on the investment management industry in the future but limiting the benefits of that impact to just a few larger companies diminishes the resiliency of the overall industry and creates larger barriers of entry for disrupters.

Cryptocurrencies and Digital Assets

One area where the SEC remains active, at least from a litigation perspective, is cryptocurrencies and digital assets, but the Commission’s case against Coinbase may be revealing weaknesses in the SEC’s approach to regulating such assets. Recently filings by Coinbase have argued that once a digital asset gains sufficient scale, it’s no longer dependent on the initial developer to continue achieving profits. If true, this removes one of the critical elements of the Howey investment contract test on which the SEC bases all its litigation in this space. It’s not clear how a court would rule on the argument, but it was novel enough to scare the SEC into a recent settlement that imposed no additional fines or penalties on the defendants. At the same time, Chair Gensler changed his position on whether the US Congress needs to pass new laws to grant the SEC authority to regulate digital assets. In August 2021 he said the SEC needed more Congressional authority to regulate these assets, now he’s saying that “the rules for digital assets are clear and no further congressional authority is needed for the SEC to regulate the industry.”

The SEC wasn’t the only governing body to take action in this space during the most recent quarter. In September, the Financial Accounting Standards Board (FASB) updated its rules to treat digital assets more like traditional financial assets and less like intellectual property.

Finally, Grayscale Investments won a partial victory against the SEC over its attempt to convert its closed-end fund into an open-end fund (specifically, an ETF). At the time, bitcoin (BTC) jumped 6%, settling around $27,400, as investors believed the court victory increased the likelihood of a spot BTC ETF from Grayscale, BlackRock, and ARK Investment Management LLC. But today, the digital asset trades closer to $26,000, as the initial euphoria around the news dissipated. While that puts the asset into positive territory for the past 12 months, it’s nowhere near the peak of $64,000+ that the cryptocurrency reached in November 2021. Part of the retraction was due to the SEC’s quick response that it would take its time considering a spot BTC ETFs. Such products are critical to large, institutional investors participating in the market. And their participation “could potentially lead to billions of dollars flowing into the market, significantly boosting the liquidity and stability of Bitcoin and its forks, like Bitcoin Cash and Bitcoin Spark,” according to Benzinga.

While many people remain skeptical about the long-term viability of Bitcoin, the past year has seen large institutional investors moving into the space, especially after the launch of Bitcoin futures ETFs such as ProShares BITO and risk-managed mutual funds such as IDX BTIDX. Grayscale’s Bitcoin Trust (GBTC), viewed as a proxy for institutional demand, saw its assets nearly double between March and May 2023. Other market indicators suggest that US institutional investors are increasing their participation in the market. For example, CoinDesk reported in June 2023 that 30% of BTC trading occurred during US market hours and accounted for 50% of the trading volume. The recent update to valuation standards on cryptocurrencies by the Financial Accounting Standards Board (FASB) will help establish clear and consistent valuation methods around such assets. Finally, Grayscale’s recent judicial win suggests that the regulatory environment around BTC and other digital assets may be calming as regulators are forced to focus less on enforcement and more on regulation to avoid wasting valuable legal resources.

Bo Howell | Managing Director, FinTech Law | Co-Founder/Managing Director, Joot

Multiple Rules Planned for Finalization by SEC in Near Term

The Regulatory Flexibility Act (“RFA”) requires each federal agency in April and October of each year to publish in the Federal Register an agenda identifying rules that the agency expects to consider in the next twelve months that are likely to have a significant economic impact on a substantial number of small entities. The publication of the agenda does not preclude an agency from considering or acting on any matter not included in the agenda, and an agency is not required to act on any matter that is included in the agenda.

The Office of Information and Regulatory Affairs released its Fall Unified Agenda of Regulatory and Deregulatory Actions in 2022, including the Securities and Exchange Commission (“SEC”) rule agenda for 2023. From the 2023 rulemaking agenda, the SEC released 7 final rules in the first 2 quarters of the year, and 10 final rules from June to October 2023, with more to be released at the end of the year. Companies should follow up on the new rules and update their board calendars to start implementing all required changes before each rule’s compliance date. Below is a list of rules for the 2023 fall and the 2024 spring agenda. We highlighted the items affecting funds and advisers.

2023 Fall Agenda

- Removal of References to Credit Ratings from Regulation M | Final Rule | Effective August 21, 2023

- Prohibition Against Fraud, Manipulation, or Deception in Connection with Security-Based Swaps; Prohibition against Undue Influence over Chief Compliance Officers | Final Rule | Effective August 29, 2023

- Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure | Final Rule | Effective September 5, 2023 - Initial Compliance Date: June 15, 2024.

- Adoption of Updated EDGAR Filer Manual | Final Rule | Released on September 18, 2023. Effective on the publication date in the Federal Register.

- Privacy Act Amendments | Final Rule | Effective October 26, 2023

- Private Fund Advisers; Documentation of Registered Investment Adviser Compliance | Final Rule | Effective November 13, 2023.

Compliance Date:- March 2025 for the audit rule and the quarterly statement rule (for all private fund advisers).

- For the adviser-led secondaries rule, the preferential treatment rule, and the restricted activities rule:

- September 2024 for advisers with 1.5 billion in AUM

- March 2025 for advisers with less than 1.5 billion in AUM

- Exemption for Certain Exchange Members | Final Rule | Effective November 6, 2023 - Compliance Date: September 6, 2024.

- Investment Company Names | Final Rule | Released September 20, 2023. Rule effective on the publication date in the Federal Register.

Compliance date:- 24-month compliance period for entities $1 billion or more net assets.

- 30-months compliance period for entities with less than $1 billion net assets.

- Form PF; Reporting Requirements for All Filers and Large Hedge Fund Advisers and Private Equity Fund Advisers; Requirements for Large Private Equity Fund Adviser Reporting | Final Rule | Effective June 11, 2024.

Compliance Date:- Amendments to Form PF sections 5 and 6 (referenced in 17 CFR 279.9) effective December 11, 2023

- For the amended, existing Form PF sections and amendments to 17 CFR 275.204(b)- 1, effective date June 11, 2024.

- Money Market Fund Reforms; Form PF Reporting Requirements for Large Liquidity Fund Advisers; Technical Amendments to Form N-CSR and Form N-1A | Final Rule | Effective June 11, 2024

Compliance Date:- 6 months after the effective date for Forms N-MFP and N-CR amendments, except for the existing fee and gate re- porting requirements in Form N-CR.

- 12 months after the effective date for the Mandatory and Discretionary Liquidity Fee Frameworks.

- 6 months for non-government money market funds to comply with the amended discretionary liquidity fee framework.

- Climate Change Disclosure | Proposal

- Special Purpose Acquisition Companies | Proposal

- Rule 14a-8 Amendments | Proposal

- Modernization of Beneficial Ownership Reporting | Proposal

- Safeguarding Advisory Client Assets | Proposal

- Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices | Proposal

- Open-End Fund Liquidity Risk Management Programs and Swing Pricing; Form N–PORT Reporting | Proposal

- Cybersecurity Risk Management for Investment Advisers, Registered Investment Companies, and Business Development Companies | Proposal

- Clearing Agency Governance and Conflicts of Interest | Proposal

- Rules Relating to Security-Based Swap Execution and Registration and Regulation of Security-Based Swap Execution Facilities | Proposal

- Short Sale Disclosure Reforms | Proposal

- Amendments to Exchange Act Rule 3b-16 re Definition of “Exchange”; Regulation ATS and Regulation SCI for ATSs That Trade U.S. Government Securities, NMS Stocks and Other Securities | Proposal

- Amendments to NMS Plan for the Consolidated Audit Trail-Data Security | Joint Industry Plan; Order Approving an Amendment to the National Market System Plan Governing the Consolidated Audit Trail

- Loan or Borrowing of Securities | Proposal

- Standards for Covered Clearing Agencies for U.S. Treasury Securities and Application of the Broker-Dealer Customer Protection Rule with Respect to U.S. Treasury Securities | Proposal

- Further Definition of “As a Part of a Regular Business” in the Definition of Dealer and Government Securities Dealer | Proposal

- Prohibition Against Conflicts of Interest in Certain Securitizations | Proposal

- Outsourcing by Investment Advisers | Proposal

- Regulation SP: Privacy of Consumer Financial Information and Safeguarding Customer Information | Proposal

- Cybersecurity Risk Management Rules for Broker-Dealers, Clear- ing Agencies, MSBSPs, the MSRB, National Securities Associations, National Securities Exchanges, SBSDRs, SBS Dealers, and Transfer Agents | Proposal

- Regulation Systems Compliance and Integrity | Proposal

- Electronic Submission of Certain Materials Under the Securities Exchange Act of 1934; Amendments Regarding FOCUS Report | Proposal

- Order Competition Rule | Proposal

- Disclosure of Order Execution Information | Proposal

- Regulation NMS: Minimum Pricing Increments, Access Fees, and Transparency of Better Priced Orders | Proposal

- Regulation Best Execution | Proposal

- Exemption for Certain Investment Advisers Operating Through the Internet | Proposal

- Conflicts of Interest Associated with the Use of Predictive Data Analytics by Broker Dealers and Investment Advisers | Proposal

- Daily Computation of Customer and Broker-Dealer Reserve Requirements under the Broker-Dealer Customer Protection Rule | Proposal

SEC Regulatory Activity & Risk Alerts

SEC Adopts Money Market Fund Reforms and Amendments to Form PF Requirements

The SEC adopted new rules that govern money market funds and how these funds report information via filings. Primarily, these new rules addressed issues related to rapid redemptions, costs, and minimum liquidity. (7/14/23)

SEC Proposes Reforms Relating to Investment Advisers Operating Exclusively Through the Internet

The SEC proposed new amendments related to advisers relying on the Internet adviser registration rule. The proposal primarily relates to the uses and needs of an operational interactive website that is always available for investors. (7/26/23)

SEC Proposes New Requirements to Address Risks from Conflicts of Interest Associated with Use of Predictive Data Analytics by Broker-Dealers and RIAs

The SEC proposed new requirements for broker-dealers and investment advisers that utilize predictive data analytics and similar technologies to interact with investors. These new requirements address the possible conflicts of interest within these interactions to ensure these firms do not put their interests above that of the investors. (8/2/23)

SEC Enhances Regulations of Private Fund Advisers

In September of this year, the SEC announced it had adopted new rules and rule amendments to enhance the regulation of private fund advisers. The SEC stated these new rules and associated amendments were designed to protect private fund investors through increased transparency, competition, and overall efficiency of the private funds market. (9/8/23)

SEC Releases Risk Alert for Investment Advisers: Assessing Risks, Scoping Examinations, and Requesting Documents

The SEC has released a risk alert detailing its specific risk-based approach when selecting advisers to examine. The SEC breaks down how it selects firms, what areas in which it chooses to examine, and provides details on what kinds of documents are requested during examinations. (9/14/23)

SEC Enforcement Actions

SEC Charges Celsius Network Limited & Founder with Fraud & Unregistered Sale of Securities

The SEC announced charges against Celsius and its founder, Alex Mashinsky, with fraud and the unregistered offer and sale of securities. Some of these charges include failing to register the offers and sales of Celsius’s crypto lending product, the Earn Interest program (EIP); making false and misleading statements to investors of the EIP and Celsius’s cryptocurrency, CEL; and engaging in market manipulation as it relates to CEL. (7/19/23)

SEC Charges Digital World SPAC for Material Misrepresentations to Investors

The SEC staff charged Special Purpose Acquisition Company (SPAC) Digital World Acquisition Corporation (DWAC) for material misrepresentations on SEC filings regarding their initial public offering and proposed merger with Trump Media & Technology Group. (7/26/23)

SEC Charges Fund Administrator Theorem Fund Services for Missing Red Flags Related to Fraud

The SEC recently settled charges against Florida fund administrator Theorem Fund Services, LLC (TFS) for failing to respond to fraud-related red flags against a private fund and its investors. According to the SEC’s order, TFS calculated the Net Asset Value (NAV) for a fund in which it provided administrative services. However, the NAV did not recognize the fund’s losses and materially overstated the value of the fund’s client investments. (8/09/23)

SEC Charges Dually Registered Broker-Dealer and Investment Adviser Wedbush Securities for Record keeping Failures

The SEC staff charged Wedbush Securities Inc. regarding Wedbush employees communicating via text messaging and other messaging apps on personal devices. These devices and applications were not considered approved methods of communication for business purposes by the firm and thus were in violation of Wedbush’s compliance and security policies. (8/18/23)

SEC Announced Its First Enforcement Action of Amended Marketing Rule

The SEC charged FinTech RIA Titan Global Capital Management USA, LLC for using hypothetical performance metrics in advertisements that were misleading, including multiple other Marketing Rule violations. The SEC claims Titan made misleading statements on its website regarding hypothetical performance, claiming that “annualized” performance results for its Titan Crypto strategy were as high as 2,700%. (8/25/23)

SEC Charges Washington D.C. Investment Adviser Fundrise Advisors, LLC with Violations of Cash Solicitation Rule

The SEC alleges that from February 2016 to December 2021, Fundrise paid over $8 million to over 200 social media influencers and content creators to solicit Fundrise advisory clients without the proper disclosures and documentation. (9/1/23)

SEC Charges Private Equity Firm Prime Group for Inadequate Disclosure of Fees Paid to Affiliate

The SEC alleges that Prime Group Holdings, LLC failed to adequately disclose millions of dollars of real estate brokerage fees paid to a real estate brokerage firm owned by Prime Group’s CEO. Between 2017 and 2021, the affiliated real estate brokerage firm received nearly $18 million in brokerage fees at the closing of a fund’s property acquisitions. (9/20/23)

SEC Sweep into Marketing Rule Violations Results in Charges Against Nine Investment Advisers

The SEC announced charges against nine registered investment advisers for Marketing Rule violations related to hypothetical performance advertisements. This follows an August 2023 enforcement action regarding similar hypothetical performance issues. (9/22/23)

Joot/FinTech Law Blog Updates

The Marketing Rule is Still a Top Compliance Concern

In June 2023, the SEC released another risk alert regarding the Marketing Rule, and a recent IAA survey has found that the Marketing Rule and some of its finer nuances remain a top compliance concern with investment advisors. Through this survey of nearly 600 investment advisers, the IAA found that the new ability to use testimonials and endorsements, and the Marketing Rule as a whole, is the number one concern of these advisers. (7/21/23)

New Rules for Private Funds:5 Things Every Fund Manager Should Know About the Rule and 3 Things to Do Now

In August 2023, the SEC adopted new rules and rule amendments for Private Funds, and there are steps fund managers should be taking now in preparation for the changes in the rules. FinTech Law’s Bo Howell and Irina Garcia Iglesias break down what private fund managers need to know about these new regulations. (9/29/23)

Industry News & Commentary

6 Essential Questions Audit Committees Should Be Asking Their Auditors

A friend of FinTech Law & Joot, accounting firm Cohen & Co. have released an important piece discussing important questions fund audit committees need to be asking their outside auditors. These questions cover fraud risks, risk assessment, auditing and accounting risks, digital assets, merger and acquisition activities, the use of the work of other auditors, talent and its impact on audit quality, independence, critical audit matters and cybersecurity.

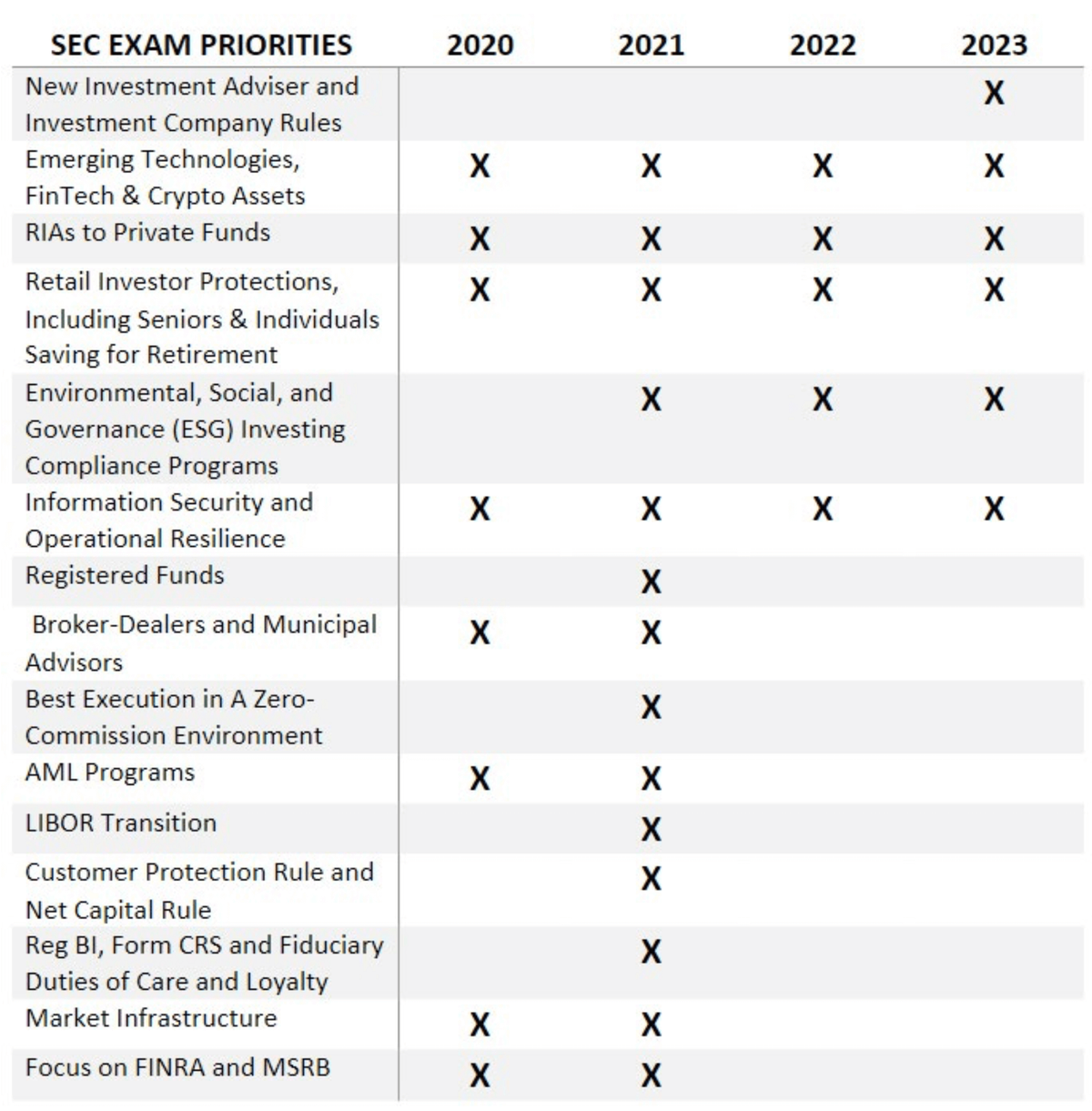

SEC Exam Priority Crossover: 2020 - 2023

The Joot team reviewed the SEC’s examination priorities from 2020 to 2023 and found some significant crossover in priorities of the previous years. There are four key exam priorities the SEC has focused on since 2020 and, through 2022’s groundbreaking year of enforcement actions, the 2023 priorities suggest the SEC will continue to focus on these areas with extreme precision.

- Emerging Technologies, FinTech, & Crypto Assets

- RIAs to Private Funds

- Retail Investor Protections, including Seniors & Individuals Saving for Retirement

- Information Security and Operational Resilience

With cryptocurrency and DeFi events flooding the news and issues with investors losing large portions of their investments highlight front pages, it is easy to understand why these four priorities are on the SEC’s mind. Emerging technologies go hand-in-hand with retail investor protection issues and information security mishaps. As these priorities continue to be a main focus, we encourage our clients and readers to revisit their compliance programs and requirements to make sure their investors are securely protected and actions are in place to alleviate and potential compliance gaps.

Book Consultation

Need help understanding how to ensure compliance and transparency in your Fintech company?

Contact us today for a consultation.