2023 - Q2 Newsletter

FinTech Law & Joot

FinTech Law is an innovative, technology-driven law firm that provides legal and consulting services to startups, crypto-related and other technology companies, investment advisers, broker-dealers, private funds, registered funds, and other financial services companies.

Joot is a technology-driven compliance company that provides services to registered investment advisers and registered investment companies, such as mutual funds, closed-end funds, and ETFs. Joot’s clients include retail advisers, institutional managers, private fund managers, and mutual fund advisers.

For more information, please visit us online at fintechlegal.io and joot.io or contact us at info@fintechlegal.io.

Highlights

In June, the Investment Advisers Association released its Investment Adviser Industry Snapshot 2023 (data as of 12/31/22), which provides a nice overview of the asset management industry. As expected, the industry continues to grow each year, with the number of SEC-registered investment advisers topping 15,000 for the first time ever! Unfortunately, the number of clients and assets under management were down from 2021. But the data provides some interesting trends to watch as 2023 the industry continues down a path of increase regulation and consolidation of service providers (e.g., custodians, administrators, compliance, and distribution).

First, let’s talk about the overall growth of the industry.

- The total number of investment advisers grew by 2.1%.

- 88.5% of advisers managed less than $5 billion in AUM (smaller advisers), but over 90% of industry assets were managed by the largest 11.5% of investment advisers.

- The number of smaller advisers has remained relatively consistent over the past 11 years, declining from 90% in 2011 to 88% in 2022.

- The number of smaller investment advisers decreased for the first time since 2018, with the number of firms employing 100 or fewer employees declining from 93% (2018 through 2022) to 91.7%.

Given the nominal growth in the number of investment advisers and the slight decrease in the number of small advisers, the data suggests that some firms are successfully growing past the $5 billion in AUM mark and industry assets are increasingly concentrated in fewer firms (i.e., the top 12%). Some of this growth is due to an active acquisition market, with smaller advisers being absorbed into larger platforms.

This trend away from smaller firms is also evident in employment numbers.

- 36% of advisers employ 5 or fewer people, an increase of 3% since 2020.

- 22% employ 6 to 10 employees, which has remained flat since 2020.

- 30% employ 11 to 50 employees, an increase of 2%.

Again, the trend suggests a noticeable number of firms are growing beyond 10 employees, but not past 50 employees. In other words, there is growth from smaller to middle sized advisers, but few firms are breaking into the top tier. While most of the growth in new investment advisers is in the lowest bracket, fewer firms are growing past 10 employees.

From an asset perspective, growth has been concentrated in only a few distribution channels.

- Business Development Companies and Charitable Organizations grew by over 26%!

- Pension and Profit-Sharing plan assets grew by 16%.

- High net worth individuals, private funds, and insurance company assets grew by 5-6%.

- All other areas, including non-high network individuals and investment companies, were either flat or shrank.

The mutual fund market seems to be going through an existential shift, as fewer smaller investment advisers launch mutual funds and ETFs, while the larger fund families continue to gather assets and launch new products. The other shift affecting the mutual fund space is the continued transfer of assets from mutual funds to ETFs. To the extent mutual funds are growing, they appear to be relying increasingly on retirement assets from pension plans and 401(k) platforms.

Finally, while the number of registered investment companies (excluding business development companies) has remained relatively flat over the years, the growth in private fund has been consistent all fund types, including hedge, private equity real estate, and venture. While the number of hedge funds has increased annually, most of the growth has been in private equity funds and venture capital funds.

Overall, the data suggests that advisers who focus on business development companies, charitable organizations, pension plans, and high net worth individuals (including private funds) are growing faster than advisers who focus on non-high net worth and traditional investment companies such as mutual funds. These trends highlight the growth in the importance of private markets over the past few years.

Managing Director | Bo J. Howell

SEC Regulatory Activity & Risk Alerts

SEC Announces Risk Alert for Newly Registered Investment Advisers

At the beginning of April, the SEC released a risk alert specific to newly registered investment advisers. This risk alert highlighted any commonalities, potential risks, or issues the SEC believes may arise in the new, growing landscape of investors and advisers alike. (4/5/23)

SEC Staff Issues Bulletin Duty of Care

Recently, the staff at the U.S. Securities and Exchange Commission published a “FAQ”-style bulletin specifically directed to broker-dealers and investment advisers and their “care obligations when they are providing investment advice and recommendations to retail investors.” The staff mentioned a few core components to the bulletin as well as special considerations for advisers. (4/28/23)

SEC Risk Alert: Safeguarding Customer Records and Info at Branch Offices

The SEC released a risk alert to registered investment advisers and other industry members on the importance of written polices and procedures for protecting customer and client records across branch offices. The staff released this alert after finding various common branch office issues through their examinations and compliance assessments. (5/3/23)

SEC Releases New Rules on Tailored Shareholder Reports for Mutual Funds and ETFs

The SEC released and adopted new rules regarding tailored annual and semi-annual reports to shareholders for mutual funds and exchange-traded funds. Many of the proposed or recommended changes are items that transitioned from Form N1-A to Form N-CSR. (5/8/23)

Reminder: Form N-PX Amendment and Filing Period

With changes effective July 1, 2024, the new processes for the SEC’s Form N-PX amendments and Rule 14Ad-1 requirements begin on July 1, 2023. Registered investment advisers and industry members should take note of these changes and how to begin reporting on the adjustments. (5/17/23)

SEC Releases Risk Alert on Areas of Focus in Marketing Rule Examinations

The SEC staff have announced new focus areas in Marketing Rule examinations and assessments. These new focus areas couple the previous four review areas as well as focusing on the seven general prohibitions within the Marketing Rule. The SEC has reinstated in-person exams and are digging deeper in each examination with these new focuses. (6/23/23)

SEC Enforcement Actions

SEC Charges Sciens Diversified Managers for Compliance Failures

The SEC staff recently charged New York registered investment adviser Sciens Diversified Managers, LLC, with the failure to adopt and implement written policies concerning the valuation of fund portfolio investments. (6/02/23)

SEC Charges Investment Adviser and Fund Trustees with First Liquidity Rule Enforcement Action

The SEC recently announced charges against registered investment adviser, Pinnacle Advisors, LLC, an associated mutual fund, and multiple trustees for the fund for multiple liquidity rule violations. This liquidity rule charge is the first of its kind since its initial inception in 2016. (6/09/23)

Joot/FinTech Law Blog Updates

The Importance of Testing Compliance Procedures

The process of testing your compliance procedures goes hand-in-hand with the annual requirement of reviewing an advisor’s compliance manual. Joot’s CCO, Jessica Roeper, reviews some of the key components to compliance testing and the overall importance for registered investment advisers. (4/10/23)

Crypto Moves Overseas

Cryptocurrency still faces regulatory confusion in the United States but has become more open and widespread in the UK and European Union. FinTech Law & Joot Managing Director Bo Howell discusses recent cryptocurrency regulatory changes, or lack thereof, and how these may affect the greater industry at large. (5/23/23)

Industry News

2023 Investment Adviser Association Compliance Conference Recap

Joot Managing Director and Head of Compliance Charles Black recaps his 2023 IAA Compliance Conference, his thoughts, and key takeaways. (4/03/23)

IAA Submits Comment Letter to SEC on Safeguarding Client Assets Proposal

The Investment Adviser Association submitted a comment letter to the SEC urging the staff to make substantial changes to its proposed new rule related to the safeguarding of advisory client assets. Click here to read the Associations full letter. (5/08/23)

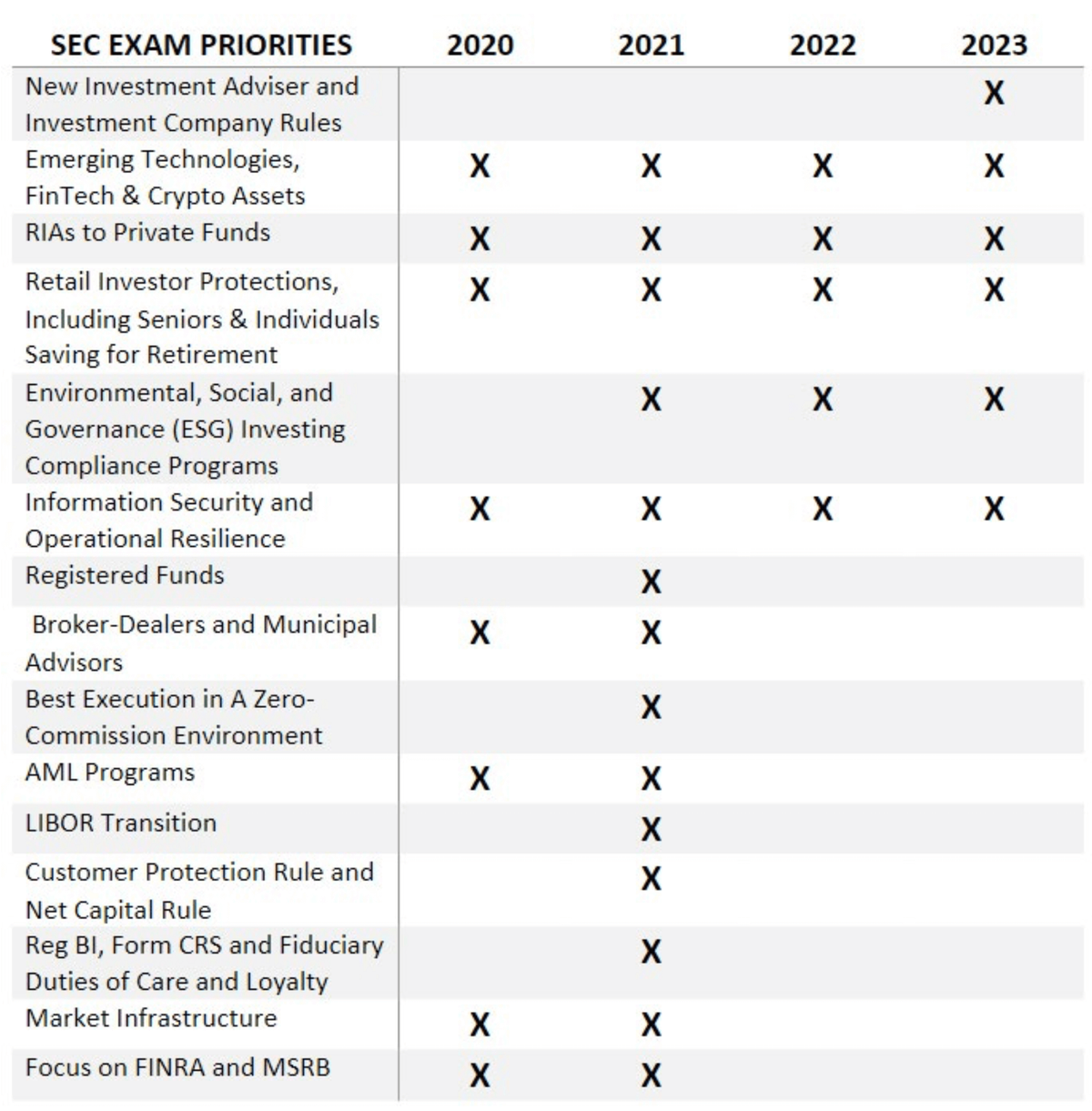

SEC Exam Priority Crossover: 2020 - 2023

The Joot team reviewed the SEC’s examination priorities from 2020 to 2023 and found some significant crossover in priorities of the previous years. There are four key exam priorities the SEC has focused on since 2020 and, through 2022’s groundbreaking year of enforcement actions, the 2023 priorities suggest the SEC will continue to focus on these areas with extreme precision.

- Emerging Technologies, FinTech, & Crypto Assets

- RIAs to Private Funds

- Retail Investor Protections, including Seniors & Individuals Saving for Retirement

- Information Security and Operational Resilience

With cryptocurrency and DeFi events flooding the news and issues with investors losing large portions of their investments highlight front pages, it is easy to understand why these four priorities are on the SEC’s mind. Emerging technologies go hand-in-hand with retail investor protection issues and information security mishaps. As these priorities continue to be a main focus, we encourage our clients and readers to revisit their compliance programs and requirements to make sure their investors are securely protected and actions are in place to alleviate and potential compliance gaps.

Book Consultation

Need help understanding how to ensure compliance and transparency in your Fintech company?

Contact us today for a consultation.