2025 - May Newsletter

Welcome to

The Startup Solution

Newsletter

In this edition of The Startup Solution, we explore the Key Fintech Trends for 2025, offering strategic insights for venture capital leaders navigating a market shaped by innovation, regulation, and global dynamics.

The newsletter dives deep into the investment climate, AI-driven innovation, open banking regulations, regtech growth, and the rise of private credit, with data from KPMG, Bloomberg, BIS, and Deloitte.

We also feature “Types of Startup Funding for Venture Capital Success (Part 1)”, a comprehensive guide that explains every stage of startup funding—from Micro Venture Capital to Series D and beyond.

Each round is explained with clear investment values, timing expectations, and legal considerations to help founders plan and scale effectively.

Excitingly, we’ve launched our new Fintech Legal website with improved navigation, richer resources, and easier access to SEC compliance and startup legal services. Whether you're raising capital, protecting IP, or expanding globally, our updated platform is designed to support your growth.

Furthermore, don’t miss the latest articles on The Fintech Blog, including:

- Registered Investment Fund Report: Support Small Managers

- Unlock Exempt Offerings Without the Complexity of Public Offerings

- Private Funds 2024: Key Trends & Developments

- Legal Essentials Every Fintech Startup Must Know Before Raising Capital

Plus, we highlight breaking fintech news—from TPG & Corpay’s $2.2B acquisition of AvidXchange, to Ant Financial’s reduced Paytm stake, to iCapital’s acquisition of Citi’s private-market unit.

Stay informed. Stay compliant. Stay ahead.

Visit us at www.fintechlegal.io or contact us to book a consultation and let our startup law team handle the legal complexities—so you can focus on building your fintech future.

Bo Howell

Key Fintech Trends 2025: Venture Capital Strategic Insights

Fintech trends for 2025 reveal a market where venture capital investors and fintech executives are navigating a landscape shaped by technological innovation, evolving regulations, political turmoil, and shifting market dynamics.While many fintech trends from 2024 continue, new dynamics are significantly influencing strategic investments and operational priorities.

This comprehensive analysis explores key fintech trends for 2025, integrating data-driven insights and actionable recommendations for venture capital leaders in the sector.

Investment Climate: Cautious Optimism and Strategic Consolidation

2024 was challenging for the global fintech market, marking significant investment-level drops.

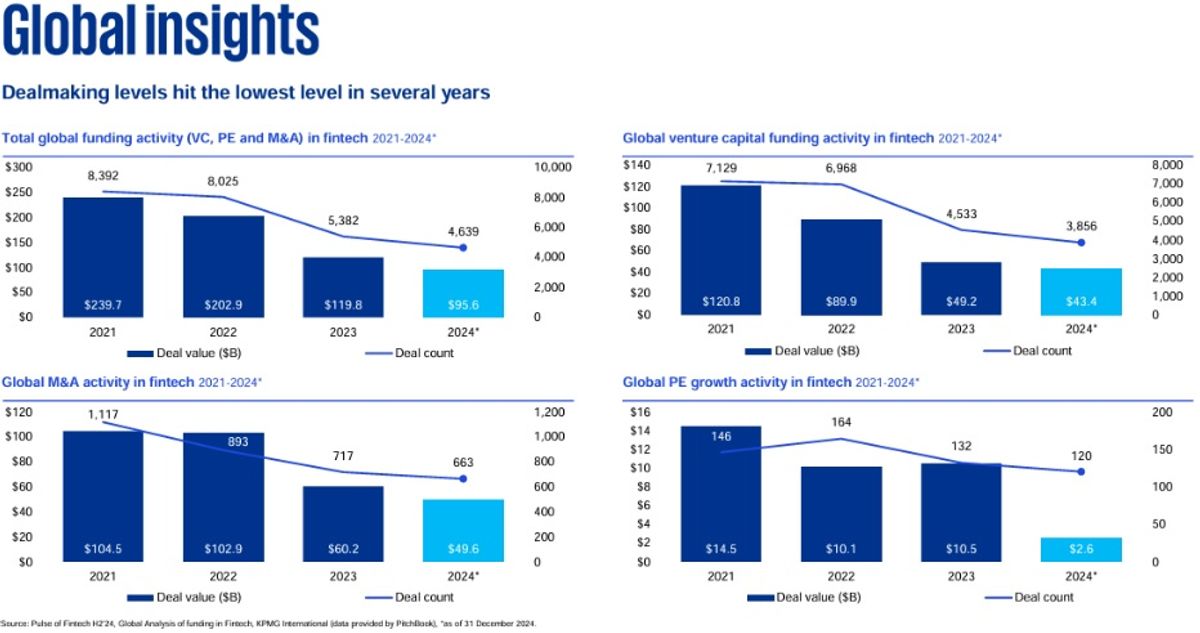

According to KPMG’s Pulse of Fintech H2 2024 report (and as illustrated in their graphs below), global fintech investment and deal volume fell to seven-year lows, totaling $95.6 billion across 4,639 deals.

This was driven by macroeconomic uncertainties, geopolitical tensions, and major elections. Specifically, global investment declined from $51.7 billion in H1 2024 to $43.9 billion in H2 2024.

Despite this, there was a notable recovery in Q4 of 2024, as mergers and acquisitions (M&A) deal value nearly doubled from $7.4 billion to $14.2 billion, and venture capital (VC) investment rose from $9.7 billion to $11.2 billion quarter-over-quarter (KPMG Pulse of Fintech).

Figure 1: Global Fintech Funding Activity (VC, PE, and M&A) 2021-2024. Source: KPMG Pulse of Fintech H2’24 report, data provided by PitchBook, December 31, 2024. Available at: kpmg.com/fintechpulse.

The Americas dominated fintech investment, attracting $31 billion in H2 2024 and hosting the only $1 billion+ deals globally.

Major transactions included Nuvei ($6.3 billion), Envestnet ($4.5 billion), and Candescent ($2.45 billion).

In contrast, Europe, the Middle East, and Africa (EMEA) secured $7.3 billion, highlighted by the acquisition of Netherlands-based Knab Bank ($561 million), indicating fewer mega-deals and reflecting cautious investor sentiment.

Asia-Pacific (APAC) attracted $5.5 billion, with significant deals such as a $788 million funding round for Philippines-based Mynt.

Payments remained the leading fintech subsector globally, securing $31 billion, followed by digital assets ($9.1 billion) and regtech ($7.4 billion).

Technological Evolution: AI-Driven Innovation Accelerates

Artificial Intelligence (AI) remains pivotal, driving fintech innovation beyond traditional roles such as fraud detection.

AI now powers advanced predictive analytics, automated decision-making, and complex risk management models.

MarketWatch (2025) highlights substantial AI investment, with firms such as Visa allocating over $10 billion to technology development in the past decade, with $3 billion to AI infrastructure (MarketWatch).

Much of this spending is going toward antifraud and cybersecurity development, but not all of it.

Fintech firms increasingly use AI for hyper-personalization, significantly enhancing customer engagement and loyalty—key metrics driving valuation and competitive advantage.

Opportunities exist for fintech startups to focus on customer interactions to help drive satisfaction and scalability.

The development of these technologies will likely lead to an AI-onshoring trend as companies use technology to engage with customers instead of low-cost, overseas call centers.

Regulatory Landscape: Expanding Open Banking and Compliance Requirements

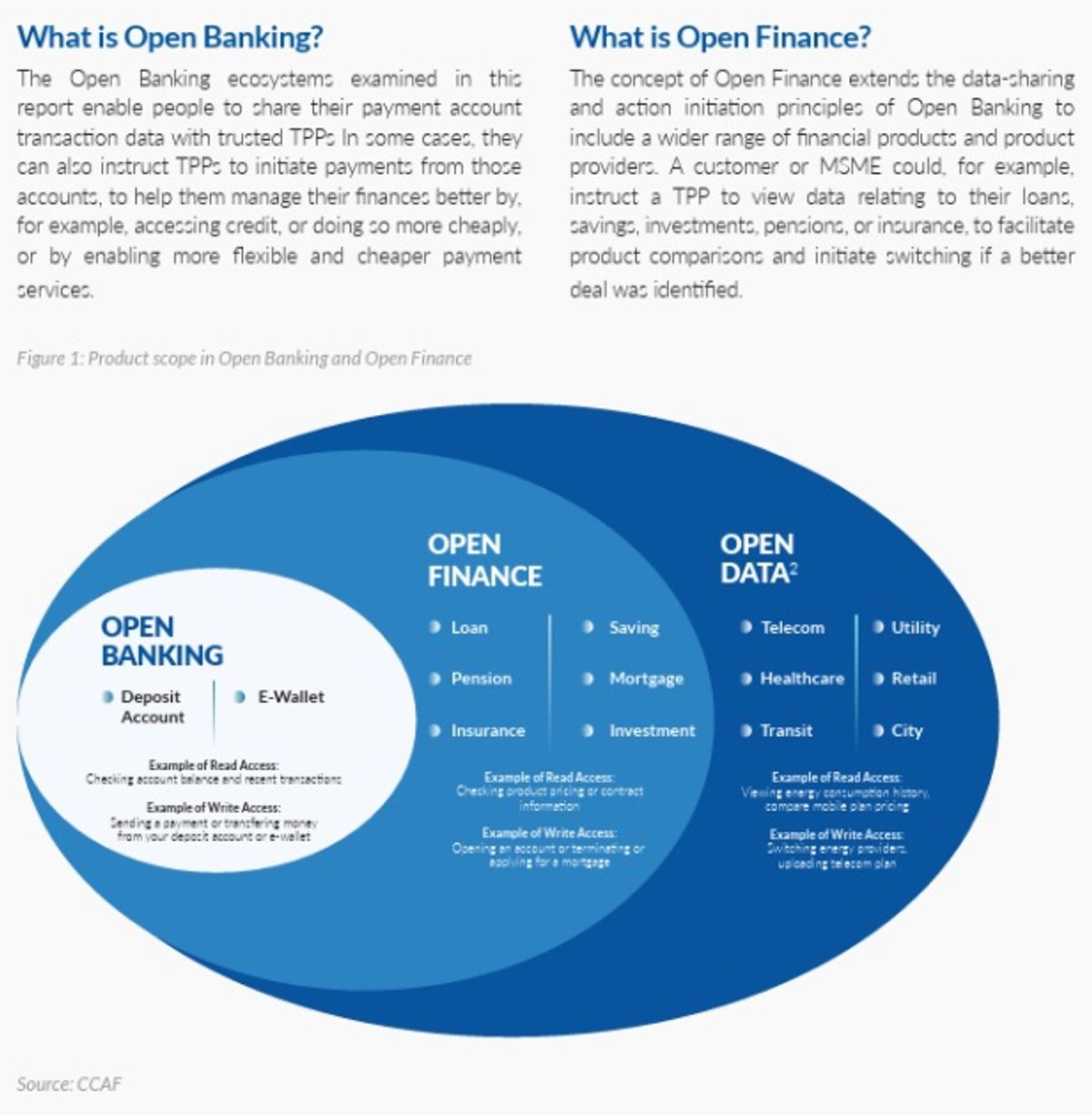

While AI dominates headlines, fintech continues to progress in other areas. Open banking regulations have become firmly established globally.

Over 60 jurisdictions have adopted comprehensive frameworks, significantly transforming the fintech landscape (Cambridge Centre for Alternative Finance, 2025).

In the U.S., Consumer Financial Protection Bureau regulations have notably strengthened bank-fintech partnerships, enhancing competition and fostering innovation (Reuters).

Figure 2: CCAF (2024), The Global State of Open Banking and Open Finance, Cambridge: Cambridge Centre for Alternative Finance, Cambridge Judge Business School, University of Cambridge, p. 13.

Additionally, heightened compliance demands around data security and financial reporting, notably enhanced Form PF requirements by the U.S. Securities and Exchange Commission (SEC), which require increased data reporting by private fund managers, are driving growth in regulatory technology (RegTech), creating opportunities for fintech firms specializing in compliance solutions.

However, the challenge with RegTech is that the overall B2B market size for products remains relatively small compared to consumer-oriented products, and many market participants are small or mid-sized businesses that are price-sensitive.

Adjustments in Venture Capital and Private Equity

Venture capital continues cautiously, targeting fintech startups with clear profitability paths and operational scalability.

Despite lower overall volumes, strategic investments persist in high-value areas such as AI, regulatory technology, and digital payments.

However, the venture capital market has undergone a systemic change over the past decade, as more and more successful startups struggle to find a path to an initial public offering or other exit that rewards investors, including late-stage investors who often participate at high valuations.

Overall, most venture capital investors have to wait longer to see a return on investment, and those that do often see it as a secondary market transaction (i.e., a resale of private securities in private markets).

According to Bloomberg (2025), “[a]n estimated $122 billion in assets are expected to change hands in the secondary market in 2025, up from $25 billion in 2012.” (Why the Venture Capital Secondary Market Is So Hot Right Now.)

Figure 3: Why the Venture Capital Secondary Market is So Hot Right Now, Bloomberg, citing The Secondary Market is Booming, Industry Ventures

These secondary transactions come with heightened risks, especially compared to public secondary transactions.

For one, private investors have less access to the portfolio company’s financial and performance information, and approval by managers or general partners to private funds is often required to complete a transaction, which is not automatic. This lack of information can create valuation issues.

Additionally, asset verification is an issue, especially if the private securities are those of a special-purpose vehicle (SPV) or other pooled investment vehicle (PIV) that has not invested directly with the underlying portfolio company. This layering of secondary transactions can make it challenging to prove who owns what.

Private equity remains robust, especially in tech-driven fintech acquisitions. Strategic alignment in valuation expectations facilitates active deal-making, enhancing sector growth.

However, like venture capital markets, PE markets have seen a rise in secondary transactions, especially manager- or GP-led secondary transactions.

While asset verification is less of an issue in PE markets, which don’t have as many layers as the VC space, valuation is still a potential risk. In manager- and GP-led transactions, there is an inherent conflict of interest for the manager/GP to maximize the asset price to juice the returns of the initial fund at the expense of the continuation fund.

Regulators are paying more attention to these transactions to ensure that later investors receive a fair price for their subscriptions.

Realistic valuations persist, with fintech firms emphasizing robust liquidity management strategies to mitigate risks associated with extended holding periods and reliance on Net Asset Value (NAV) lending. Solutions providing improved valuation transparency and innovative liquidity management tools remain attractive to investors.

The Rise of Private Credit

Private credit continues to experience strong growth, driven by investor demand for yield amid fluctuating interest rates and market volatility.

These strategies encompass direct lending, mezzanine debt, distressed debt, and special situations, and are used by many borrowers as substitutes for traditional loans.

Institutional investors have significantly increased allocations to private credit strategies, presenting opportunities for fintech platforms focused on enhancing lending efficiency, risk management, and asset management.

According to the Bank of International Settlements (BIS), global private credit assets under management (AUM) have grown from $0.2 billion to $2,500 billion in the past two decades, while the volume of loans has increased from $100 billion to over $1.2 trillion; 87% of these loans originate in the U.S. (The global drivers of private credit.)

The BIS found that private credit is most popular in countries with low interest rates, a falling cost of equity, and increased leverage of business development companies (BDCs), all of which describe the United States to a “t.”

As funding costs decline, the attractiveness of private credit as an alternative to traditional banks increases. According to Deloitte (2024), private credit has replaced the traditional syndicate loan market for leveraged buyouts (Deloitte: How a Credit Surge is Reshaping Corporate Lending | FinTech Magazine), including buyouts of fintech companies.

Regional Fintech Trends & Growth: Latin America and Asia-Pacific

Latin America, particularly Mexico and Brazil, continues robust fintech growth driven by digital adoption and venture capital investment.

Notable examples include Mexico’s Clara, which achieved unicorn status, exceeding $1 billion (Financial Times), and Brazil’s Nubank, maintaining its position as a leading global digital bank (CB Insights).

The Asia-Pacific region also thrives, with India surpassing 87 billion digital payment transactions in 2024, Indonesia attracting $1.5 billion in fintech investments, and Vietnam experiencing a 35% investment growth year-over-year (Tech in Asia).

Strategic Recommendations for Venture Capital Leaders in 2025

To effectively navigate the evolving fintech landscape, fintech executives and venture capital investors should:

- Accelerate AI Implementation

Prioritize investments in advanced AI for predictive analytics and personalization. - Enhance RegTech Capabilities

Invest in or partner with robust regulatory technology providers for streamlined compliance management. - Capitalize on Private Credit Market Growth

Focus fintech innovations on lending efficiency, risk management, and asset management strategies. - Strengthen Valuation and Liquidity Management Practices

Implement transparent valuation methodologies and proactive liquidity management solutions.

Final Thoughts

In 2025, fintech trends continue to evolve through strategic investments, technological advancements, regulatory developments, and market-driven adaptations.

Leaders who proactively engage with these fintech trends will secure competitive advantages, sustainability, and long-term sector leadership.

Ready to capitalize on these fintech trends?

Types of Startup Funding for Venture Capital Success

So, you’ve decided to launch a high-growth startup. Either now or down the road, you’ll need startup funding. And to gain access to venture capital for your startup, you will need well-structured startup funding rounds.

In the article below, we explore the various stages of startup funding, and timing considerations, to help startup founders navigate the complexity of venture capital funding.

Types of Startup Funding Rounds

Each startup funding round is for a specific purpose and required at a specific time during the lifetime of a startup. Let’s take a look at the types of startup funding:

Micro venture capital

Micro Venture Capital is a form of small seed investment to help early-stage startups who have not yet gained traction. Micro venture capital is often used to help the startup company grow and gain traction. Many refer to this funding round as the “friends and family” round because founders will tap into their personal networks before seeking pre-seed or seed funding or moving on to larger venture capital rounds (i.e., Series A, Series B, etc.). These relationships have a high-degree of trust, and investors are betting on the person more than on the company. There are usually fewer than 10 investors.

Investment Value

- $25’000 to $500’000

Purpose of Micro Venture Capital Funding

- Used for early-stage startup investment, often before formal pre-seed funding.

- Often used for early-stage startup product development.

Timing of Micro Venture Capital Funding

- 0 – 12 months of the company’s life.

- Before pre-seed funding or investment in a company that is yet to gain traction. Often sought at the very start of a company when the founders have a general business plan but have yet to refine their product, services, and pitch deck.

Pre-Seed Funding

Pre-seed funding is the earliest investment(s) that a startup will receive and is usually sourced from the personal funds of the startup founder(s) themselves, their family, friends, and angel investors.Pre-seed funding is often used to validate the startup’s core business idea and to build a minimum viable product (MVP). The presence of angel investors separates this round from micro venture capital funding, as these investors will provide guidance on how to structure the company for future funding rounds and validate their business plan through market research and initial revenue generation. The expectation for these investors is a follow-up round within the next few years.

Investment Value

- $50’000 to $500’000

Purpose of Pre-Seed Funding

- Validation of core idea by building an MVP. In other words, determining the market viability of a product / service.

- Gaining early traction.

Timing of Pre-Seed Funding

- 12 – 24 months of the company’s life.

- On average, startup funding is provided for 12 to 18 months of runway to test the concept.

Seed Funding for Startups

Once proof of concept is achieved during the pre-seed funding stage of a startup, your startup can raise a seed funding round in order to develop the actual product / service. Usually companies start to see growing revenue based on early adoption of their MVP. The feedback from those early adopters directs further product development or service offerings (frequently referred to as version 1.0). Seed funding is often used as an investment into the startup’s core product / service, to expand the startup team, and to acquire early customers through a go-to-market plan.The types of investors interested in seed funding are usually angel groups or seed-stage venture capitalists.

Investment Value

- $500’000 to $5’000’000

Purpose of Seed Funding

- Accelerating early traction.

- Begin selling the startup product or service.

- Developing product-market fit by scaling the startup team and customer acquisition.

Timing of Seed Funding

- Typically, 12 to 24 months after pre-seed funding.

Series A Funding

Your product / service has now illustrated a clear product-market fit, together with consistent growth. A Series A funding round is typically applied to assist your startup to scale its operations and to expand sales and marketing. Furthermore, you may use Series A funding to optimize your product or service and to improve your business model.One of the most important factors for qualifying for Series A funding is your startup’s MoM (month-over-month) growth. It should be 12% to 20% or higher.

Investment Value

- $2’000’000 to $15’000’000

Purpose of Series A Funding

- Optimization of startup’s product-market fit.

- Scaling of operations for sales, marketing, engineering, etc.

- Refining of the business model to stimulate growth.

Timing of Series A Funding

- Series A funding is raised on average 12 to 24 months after the seed funding round has been completed, with a Series A funding round lasting about 12 to 18 months.

- Consider your startup’s MoM before considering Series A funding, as it’s often a qualifying metric and should be around 12% to 20% or more.

Series B Funding

Although your startup might not be profitable yet, you now have dedicated customers and a steady revenue stream(s).

During this phase, your company needs to continue scaling to reach more customers, develop new products, services, or features, or perhaps even expand your market reach into new territories.Funding is needed for the above, as well as for the expansion of your team, gaining more talent, and building out more infrastructure.

Investment Value

- $15’000’000 to $33’000’000

Purpose of Series B Funding

- Expanding market reach.

- Building out a team of talent to acquire market share quickly.

- Expanding sales, customer service, and aspects such as R&D.

- Investing in infrastructure.

Timing of Series B Funding

- Series B funding usually takes place 10 to 18 months after Series A funding.

- Bear in mind that the process of Series B funding itself takes about 6 to 12 months.

Series C Funding

Companies that reach Series C funding rounds have demonstrated that they are extremely successful (i.e., they have achieved sustainable high growth).

One of the primary aims of Series C funding is to expand the company’s product / service into new markets and countries and to increase its valuation in anticipation of a liquidity event such as an acquisition or Initial Public Offering (IPO). A higher valuation is important before an acquisition or Initial Public Offering (IPO).

Investment Value

- There is no limit, but it is typically around $37.4 million.

Purpose of Series C Funding

- Fueling major expansion of the startup’s product into new markets and countries, or even developing new product lines.

- Positioning the company for an IPO or a large-scale exit.

Timing of Series C Funding

- Once the company illustrates excellent revenue and customer retention.

- Usually, 2 to 3 years after a Series B funding round.

- Series C funding is often the last private funding round before a company goes public.

Series D Funding, Etc.

Historically, most companies won’t need Series D funding; recent data, however, suggests that many companies (particularly technology companies) will need five or more rounds before a liquidity event. Some need the additional funding because they are in a unique business opportunity (e.g., artificial intelligence). Others need it because of sub-par performance. In other words, the company did not meet its investor goals during Series C funding; therefore, it needs to raise additional funds.

Fund Value

- Value varies; it can be any amount needed, often between $30’000’000 and $100’000’000 or more.

Purpose of Series D / E Funding

- Usually used as a bridge to an IPO or other liquidity event.

- Used to expand company products or markets.

Timing of Series D / E Funding

- Series D, E, and further funding rounds are usually sought only if additional capital is required after a Series C funding round.

Need Help Navigating the Legal Complexity of Startup Funding?

Contact us at Fintech Law today.

Latest Fintech News

Draft US Bill Proposes Shifting Crypto Oversight from SEC to CFTC

May 7, 2025

The US House of Representatives Financial Committee and Agriculture Committee released a draft bill on May 5, 2025, that will move oversight of digital assets from the Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC).

The bill will also redefine “digital commodities” as tokens on mature, decentralized blockchains (no holder >20%).

It exempts issuance and trading—unless tied to revenue or assets—potentially cutting registration and disclosure requirements amid partisan debate.

TPG & Corpay Said to Acquire AvidXchange ($2.2 billion)

May 9, 2025

Asset management firm TPG is said to have partnered with Corpay (a company providing corporate payment system solutions) to acquire AvidXchange for 2.2 billion USD.AvidXchange delivers payment services focused on accounts-payable management for mid-market companies and their vendors.

India-China Tensions Rise: Ant Financial cuts its stake in Paytm

May 13, 2025

Ant Financial, a giant in the Chinese fintech sector and Alibaba’s fintech arm, is shedding Rs 2,200 crore Paytm stock. Consequently, Paytm stock reached a low of Rs 823.10 on the BSE.

This comes amid the Indian government’s increasing scrutiny of Chinese investments in delicate sectors, among others, fintech.

Fintech Firm iCapital Acquires Citigroup Private-Market Unit

May 13, 2025

Citigroup announced on Tuesday (13 May 2025) that it will be selling its wealth alternative unit, Citi Global Alternatives (private equity, hedge funds, private credit, etc), to iCapital, a fintech firm.

While Citi will continue to be the distributor of funds, iCapital will now be in charge of the management and operation of the platform.

SavvyMoney Acquires CreditSnap

May 14, 2025

Since its 2017 inception, CreditSnap has offered a platform automating deposit account openings and lending workflows for banks and credit unions.

SavvyMoney (a credit score solution provider) is said to have acquired CreditSnap in Texas, with the aim of integrating CreditSnap into its existing suite.

FT Partners: Record FinTech M&A 50% YoY in Q1 2025

May 2025

The FT Partners’ Q1 2025 FinTech Insights Report noted a significant increase in capital raising compared to Q1 of 2024.

- Financing volumes among private companies grew 50% YoY (totalling almost 14 billion USD).

- eToro & Klarna filed for US IPOs in March.

- During Q1 2025, there were 437 M&A transactions (56 billion USD), a new record high.