2023 - February Newsletter

FinTech Law & Joot

FinTech Law is an innovative, technology-driven law firm that provides legal and consulting services to startups, crypto-related and other technology companies, investment advisers, broker-dealers, private funds, registered funds, and other financial services companies.

Joot is a technology-driven compliance company that provides services to registered investment advisers and registered investment companies, such as mutual funds, closed-end funds, and ETFs. Joot’s clients include retail advisers, institutional managers, private fund managers, and mutual fund advisers.

For more information, please visit us online at fintechlegal.io and joot.io or contact us at info@fintechlegal.io.

Highlights

After a whirlwind year in 2022, this year is off to a slower regulatory start. No major rule implementations on the horizon and only a handful of rules in the proposal stage. Of course, that can all change overnight, but the SEC seems to be content with beating up the crypto markets and letting recent RIA and RIC rules settle into place.

While the SEC continues to focus on vendor management practices by RIA and RICs, its short-term focus is on:

- RIA compliance with Rule 206(4)-1 (the Marketing Rule);

- RIC compliance with Rule 18f-4 (the Derivatives Rule); and

- RIC compliance with Rule 2a-5 (the Valuation Rule).

Additionally, the examination staff is focused on private fund advisers, who continue to grow in numbers are capital increasingly favors private over public markets, Regulation Best Interest implementation, and ESG investing. In other words, nothing new over the past six plus months. Finally, the SEC’s rulemaking and exam priorities illustrate that it continues to focus on initial and ongoing due diligence of service companies to RIAs and RICs.

So let’s all take a moment to catch our breath, relax a little, and enjoy the end of winter.

Bo J. Howell

FinTech Law/Joot, Managing Director

SEC Regulatory Activity

SEC Publishes Short-Term and Long-Term Agendas for 2023

The SEC’s short and long-term agendas were published on January 4, 2023. Topics that could affect investment adviser and investment companies include:

Short-Term Agenda:

Matters Identified in the Proposed Rule Stage

- Digital engagement practices for investment advisers and broker-dealers

- Outsourcing by investment advisers and rules related to advisers’ oversight of third-party service providers (i.e., vendor management)

- Registered investment companies’ fees and fee disclosure (since 2022)

- Open-end fund liquidity and dilution management

- Custody rules for investment advisers

- Reg. D and Form D amendments, including updates to the accredited investor definition

Matters Identified in the Final Rule Stage

- Form PF and reporting requirements for investment advisers to private funds

- Investment adviser disclosures and governance relating to cybersecurity risks

- Rules relating to transparency, conflicts of interest, and certain other matters involving private fund advisers, and documentation of adviser compliance reviews

- Enhanced disclosures by investment advisers and funds about ESG practices

- Investment company names rule

- Money market fund reforms

- Tailored shareholder reports, treatment of annual prospectus updates for existing investors and improved fee and risk disclosure for mutual funds and ETFs, and fee information in investment company advertisements

- Enhanced reporting of proxy votes by funds and reporting on executive compensation votes by institutional investment managers

Long-Term Agenda:

- The role of certain third-party service providers and the implications for the asset management industry

- The regulatory regime for transfer agents

(1/4/23)

SEC Adds New Answer to Marketing Rule Frequently Asked Questions

Rule 206(4)-1, colloquially known as the “Marketing Rule”, under the Investment Advisers Act of 1940 became fully effective in November 2022. At the beginning of January 2023, the SEC issued another answer to their Frequently Asked Questions documentation regarding the Marketing Rule. (1/18/23)

SEC Issues Bulletin on Differential Advisory Fee Waivers

On February 2, 2023, the staff of the SEC’s Division of Investment Management issued a bulletin that cautioned investment company and their boards about the risk of cross-subsidization of differential advisory fee waivers. These arrangements permit fee waivers and expense reimbursements that cause different advisory fees to be charged to different share classes of the same fund, a practice that the staff views as prohibited cross-subsidization between classes.

(2/2/23)

SEC Division of Exams Announces 2023 Priorities

The SEC Division of Examinations announced their 2023 examination priorities. Here are a few highlights:

- New Investment Adviser and Investment Company Rules: The SEC will focus investment adviser exams on the new Marketing Rule place and for investment companies, the focus will be on the new Derivatives and Fair Valuations Rules.

- RIAs and Private Funds: The SEC will continue to focus on key areas such as the compliance program, fees and expenses, custody, conflicts of interest and the use of alternative data. For private fund advisers, they will focus on portfolio strategies, risks management and investment recommendations and allocations, conflicts and proper disclosures.

- Retail Investors and Working Families: The SEC will continue to focus on broker-dealers and RIAs are satisfying their obligations under Regulation Best Interest and the Advisers Act fiduciary standard to act in the best interests of retail investors.

- Environmental, Social and Governance (ESG): Exams will continue to focus on ESG-related advisory services and fund offerings.

- Information Security and Operational Resiliency: Exams will focus on practices to prevent interruptions to mission-critical services and protecting investor information, records and assets.

- Emerging Technologies and Crypto-Assets: The SEC plans on conducting exams of broker-dealers and RIAs that are using emerging technologies or emerging practices, including the offer, sale or recommendation of crypto-related assets.

(2/7/23)

SEC Proposes Revision to Privacy Act Rule

The SEC has proposed revisions to the Privacy Act to help clarify, update, and streamline the current rule. The revisions would codify current practices for processing requests, provider greater clarity for how individuals can access personal data and would allow for electronic methods to verify one’s identity. The proposed rule, if approved would replace the current Privacy Act regulations. (2/14/23)

SEC Proposes Enhanced Safeguarding Rules for Registered Investment Advisers

The SEC has proposed changes to the Custody Rule. The proposal includes broadening the application of the current investment adviser custody rule beyond client funds and securities but would include any client assets in an adviser’s possession or authority to obtain possession of client assets, including digital assets real estate and bank loans. These assets would be required to be kept at a qualified custodian, like a bank or broker-dealer, and the adviser must obtain written assurances from a client’s custodian that it will offer specific custodial protections. (2/15/23)

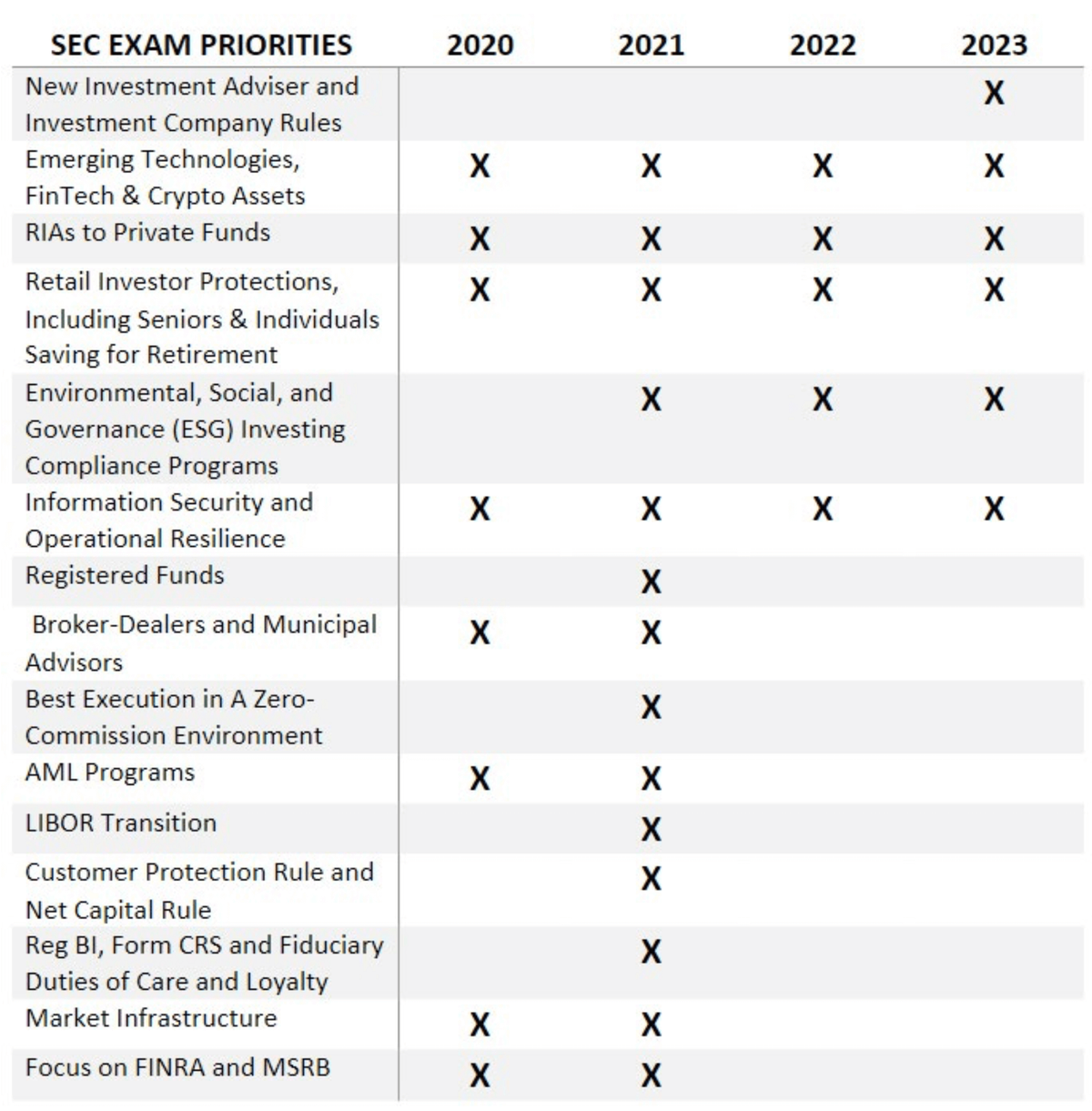

SEC Exam Priority Crossover: 2020 - 2023

The Joot team reviewed the SEC’s examination priorities from 2020 to 2023 and found some significant crossover in priorities of the previous years. There are four key exam priorities the SEC has focused on since 2020 and, through 2022’s groundbreaking year of enforcement actions, the 2023 priorities suggest the SEC will continue to focus on these areas with extreme precision.

- Emerging Technologies, FinTech, & Crypto Assets

- RIAs to Private Funds

- Retail Investor Protections, including Seniors & Individuals Saving for Retirement

- Information Security and Operational Resilience

With cryptocurrency and DeFi events flooding the news and issues with investors losing large portions of their investments highlight front pages, it is easy to understand why these four priorities are on the SEC’s mind. Emerging technologies go hand-in-hand with retail investor protection issues and information security mishaps. As these priorities continue to be a main focus, we encourage our clients and readers to revisit their compliance programs and requirements to make sure their investors are securely protected and actions are in place to alleviate and potential compliance gaps.

Federal Actions

New Exemptions for Small Business M&A Brokers

On December 29, 2022, President Biden signed into law the Consolidated Appropriations Act of 2023 (H.R. 2617) that includes an exemption from registration with the Securities and Exchange Commission for small business mergers and acquisitions brokers (“M&A brokers”), which is designed to benefit broker-dealers handling smaller deals in local communities, and to reduce initial and ongoing costs. (2/15/23)

SEC Enforcement Actions

SEC Charges Genesis and Gemini for the Unregistered Offer and Sale of Crypto Asset Securities through the Gemini Earn Lending Program

The Securities and Exchange Commission today charged Genesis Global Capital, LLC and Gemini Trust Company, LLC for the unregistered offer and sale of securities to retail investors through the Gemini Earn crypto asset lending program. Through this unregistered offering, Genesis and Gemini raised billions of dollars’ worth of crypto assets from hundreds of thousands of investors. Investigations into other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing. (1/12/23)

Bloomberg to Pay $5Million for Misleading Disclosures about its Valuation Methodologies for Fixed Income Securities

The SEC settled charges against Bloomberg Finance L.P. for misleading disclosures around their product that provides daily price valuations for fixed income securities. The order found that Bloomberg failed to disclose to its customers that the valuations for certain fixed income securities could be based on a single data input, such as a broker quote. This did not match to the methodologies it had previously disclosed. Mutual funds were using these prices to determine fund asset valuations and that Bloomberg prices could have had an impact on the price these securities were offered and traded. (1/23/23)

Kraken to DiscontinueUnregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges

The Securities and Exchange Commission today charged Payward Ventures, Inc. and Payward Trading Ltd., both commonly known as Kraken, with failing to register the offer and sale of their crypto asset staking-as-a-service program, whereby investors transfer crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21 percent. (2/9/22)

Joot/FinTech Law Blog Updates

The Diplomat vs.The Enforcer Pt.1: The Regulatory Landscape of Crypto

The overall landscape of cryptocurrency in 2023 seems to have more in common with the Wild West than anyone would like to admit. But, there is a conflict on who will take care of the regulation and governance. The SEC and CFTC are currently embroiled in debates on who should take control of the situation.

Read Part 2 of the blog here.

(1/26/23)

Raising Capital in Early-Stage Startups

Startup culture is by nature difficult and there are many hoops to jump through to achieve success. One of the most difficult aspects, especially in the early stages, is raising capital. Luckily, there are strategic steps that startups can take to properly navigate the compliance landscape of raising capital. (2/10/23)

Book Consultation

Need help understanding how to ensure compliance and transparency in your Fintech company?

Contact us today for a consultation.