Solana ETF Approval Prospects: A Comprehensive Regulatory Analysis

Solana ETF Approval Prospects: A Comprehensive Regulatory Analysis

Nine institutional issuers are awaiting SEC decisions on spot Solana ETF applications in October 2025, with Bloomberg analysts now assigning 100% approval odds following the adoption of generic listing standards in September—a dramatic shift from earlier predictions that approval wouldn't come until 2026. The transformation stems from three catalysts: Gary Gensler's January departure and replacement by pro-crypto Paul Atkins, the Trump administration's explicit commitment to making America the crypto capital of the planet, and procedural changes compressing review timelines from 240 days to 60-75 days. While Solana faces unique regulatory hurdles—including historical securities classifications in SEC enforcement actions and centralization concerns absent from Bitcoin and Ethereum—the political and regulatory environment has fundamentally changed. Multiple deadlines cluster between October 10-16, 2025, with industry consensus expecting simultaneous approval of all applications, mirroring the pattern established with Bitcoin's 11-ETF launch in January 2024.

Current status: Nine applications await final decisions amid regulatory transformation

Nine major financial institutions have filed for spot Solana ETFs, with VanEck leading as the first applicant on June 27, 2024. The complete applicant list includes 21Shares, Bitwise, Canary Capital, Grayscale (converting its existing $134 million trust), Franklin Templeton, Fidelity, CoinShares, and Invesco Galaxy, which filed most recently on June 25, 2025.

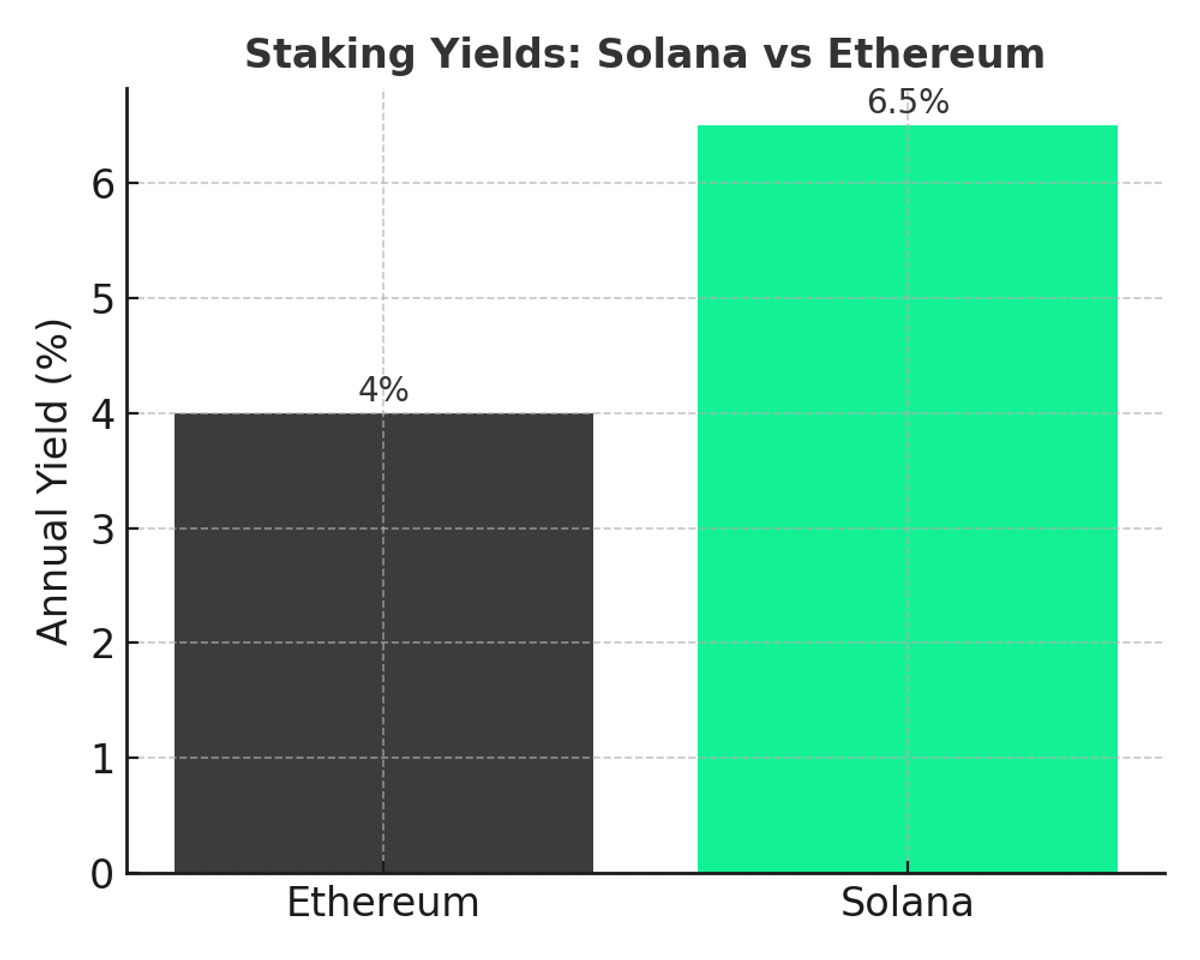

All applications remain officially pending as of October 1, 2025, though the path to approval has accelerated dramatically. Following intensive SEC engagement in June and July 2025, all nine issuers submitted amended S-1 filings that incorporated staking provisions and in-kind redemption mechanisms—critical features that distinguish these products from their predecessors. The staking component is particularly significant: Solana's proof-of-stake network offers yields ranging from 5-8% annually, compared to Ethereum's 3-5% staking return, creating a compelling value proposition for institutional investors seeking income generation alongside capital appreciation.

The SEC's September 17, 2025, approval of generic listing standards for commodity-based trust shares fundamentally altered the approval landscape. This procedural innovation eliminates the need for individual 19b-4 exchange rule filings and their associated 240-day statutory review periods, compressing the approval timeline to as little as 60-75 days.

The Bitcoin and Ethereum ETF precedents: How we got here

The path to Solana ETF approval runs through two critical precedents: Bitcoin ETF approval on January 10, 2024, and Ethereum ETF approval on May 23, 2024. Understanding these precedents illuminates why Solana approval appears increasingly inevitable despite significant obstacles.

The Bitcoin ETF breakthrough required litigation. After the SEC rejected spot Bitcoin ETF applications for over a decade, Grayscale sued the SEC in June 2022 following rejection of its application to convert its Grayscale Bitcoin Trust into an ETF. On August 29, 2023, the D.C. Circuit Court of Appeals ruled that the SEC was "arbitrary and capricious" in rejecting Grayscale's proposal while having approved Bitcoin futures ETFs. Judge Neomi Rao wrote that the Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale's similar proposed bitcoin ETP, noting that Bitcoin futures and spot prices exhibited 99.9% correlation.

When the SEC declined to appeal by the October 13, 2023 deadline, the path cleared for spot Bitcoin ETF approvals. On January 10, 2024, the Commission simultaneously approved 11 applications from BlackRock, Fidelity, Grayscale, ARK Invest, VanEck, and others. SEC Chair Gary Gensler's accompanying statement was notably grudging, emphasizing that approval was "cabined to ETPs holding one non-security commodity, bitcoin" and warning it "should in no way signal the Commission's willingness to approve listing standards for crypto asset securities."

Why Solana faces steeper regulatory hurdles than Bitcoin or Ethereum

Solana confronts three regulatory obstacles that distinguish it from its approved predecessors: explicit securities classifications in recent enforcement actions, initial token distribution via registered securities offerings, and ongoing centralization concerns related to the Solana Foundation's delegation program.

Securities classification remains the thorniest issue. The SEC named SOL as an unregistered security in its June 5, 2023 lawsuit against Binance and June 6, 2023 action against Coinbase. Unlike Bitcoin (explicitly classified as a commodity by the CFTC) or Ethereum (given tacit commodity treatment via Ethereum ETF approval), Solana has appeared on the SEC's securities list alongside Cardano, Polygon, Filecoin, and other tokens.

The May 29, 2025 SEC Staff Statement on Protocol Staking further weakened securities classification arguments. By determining that staking rewards constitute "compensation for services" rather than profits from others' entrepreneurial efforts—failing the "efforts of others" Howey prong—the SEC staff guidance undermined the Coinbase complaint's central theory.

Additional enforcement context includes the July 2022 class action lawsuit Young v. Solana Labs (Case No. 22-cv-03912, N.D. Cal.), describing SOL as a "highly centralized cryptocurrency." These private civil actions continue independently of SEC enforcement, but lack regulatory blocking power over ETF approvals.

Trump administration and Paul Atkins: Political transformation reshapes the regulatory landscape

The 2024 presidential election fundamentally altered cryptocurrency regulatory prospects. Donald Trump's return to the White House, combined with his explicit pro-crypto platform promises and appointment of Paul Atkins as SEC Chair, eliminated the primary obstacle to Solana ETF approval: Gary Gensler's enforcement-first approach and classification of nearly all cryptocurrencies except Bitcoin as securities.

Trump's commitment at the July 2024 Bitcoin Conference in Nashville was to ensure America becomes "the crypto capital of the planet and bitcoin superpower of the world." This wasn't campaign rhetoric but policy priority—upon inauguration January 20, 2025, Trump immediately nominated Paul Atkins to replace Gensler.

Atkins, who previously served as SEC Commissioner from 2002-2008, had been CEO of Patomak Global Partners, a fintech consulting firm advising cryptocurrency companies on regulatory compliance. His appointment signaled wholesale reversal of SEC crypto policy.

The impact was immediate. In late January 2025, the SEC moved to dismiss major enforcement actions. Most critically for Solana ETFs, the SEC withdrew its securities classification allegations against specific tokens in the Binance and Coinbase cases. While not formally conceding SOL is not a security, the SEC's decision to amend complaints to remove "Third Party Crypto Asset Securities" language effectively eliminated the precedent that would have blocked commodity-based Solana ETFs.

Expert consensus shifts from skepticism to certainty

Bloomberg Intelligence analysts James Seyffart and Eric Balchunas—the most closely watched ETF experts—underwent a dramatic opinion evolution throughout 2025. In January 2025, Seyffart predicted Solana ETFs "may not launch until 2026", reasoning that 240-260 day review timelines combined with the SEC Division of Enforcement's securities classification would prevent other divisions from analyzing applications under a commodities framework. This pessimistic assessment reflected the regulatory environment under Gary Gensler's final months as SEC Chair.

By April 2025, odds improved to 90% as Gensler's departure became certain and Paul Atkins' nomination as his replacement signaled regulatory shift. The probability increased to 95% in June 2025 following the SEC's request for amended filings incorporating staking provisions—viewed as constructive engagement rather than obstruction.

The breakthrough came September 30, 2025, when Balchunas announced on X: "Honestly, the odds are really 100% now." The catalyst was the SEC's adoption of generic listing standards making 19b-4 exchange filings and their statutory review "clock" obsolete. He explained: "That just leaves the S-1s waiting for formal green light from Corp Finance. And they just submitted amendment #4 for Solana. The baby could come any day. Be ready."

Regulatory safeguards: Staking, custody, and market manipulation

Three technical requirements underpin the SEC's willingness to approve Solana ETFs under Chairman Atkins: staking guidance, institutional custody standards, and market surveillance mechanisms.

The May 29, 2025 SEC Staff Statement on Protocol Staking represented a watershed moment. For years, the SEC had viewed staking programs as unregistered securities offerings, with Gensler's SEC bringing enforcement actions against Coinbase and Kraken for offering staking services. The Staff Statement reversed this position for "protocol staking"—staking crypto assets intrinsically linked to a public, permissionless network's consensus mechanism.

The key finding stated that staking rewards are "compensation for services" rather than profits from others' entrepreneurial efforts, failing the critical "efforts of others" prong of the Howey Test. The guidance characterized node operators' validation activities as "administrative or ministerial" rather than the entrepreneurial efforts that trigger securities classification.

This May 2025 statement catalyzed the June-July amendment wave, with all nine Solana ETF applicants incorporating staking provisions into revised S-1 filings. VanEck, 21Shares, Bitwise, Canary Capital, Fidelity, and others now explicitly include staking features through trusted third-party providers like Marinade and Coinbase. The Canadian precedent reinforces viability: four spot Solana ETFs launched on the Toronto Stock Exchange in April 2025 with staking enabled, and 3iQ's SOLQ amassed C$90 million in its first two trading days.

Custody and market manipulation safeguards address the SEC's core investor protection mandate. All applications designate institutional custodians—primarily Coinbase Custody and BitGo Trust—meeting SEC standards for digital asset safekeeping. These custodians must demonstrate robust security protocols, insurance coverage, and operational track records.

Market surveillance mechanisms proved pivotal in Bitcoin ETF approval. The SEC required surveillance-sharing agreements (SSAs) with "significant markets" to detect and prevent price manipulation. For Bitcoin, the solution emerged through CME's regulated futures market and its 99.9% correlation with spot prices—manipulation in spot markets would necessarily affect futures prices, making CME surveillance effective for detecting bad actors. Solana initially lacked this infrastructure, but CME launched Solana futures contracts in March 2025, establishing the regulated derivatives market prerequisite.

Timeline expectations: October deadlines and the path forward

The October 2025 deadline cluster creates extraordinary concentration of regulatory decisions—16+ cryptocurrency ETF applications across multiple assets face final determinations within a three-week window. For Solana specifically, Grayscale's trust conversion faces an October 10, 2025 deadline, with multiple other issuers confronting October 16 decisions. Bloomberg analysts characterize October as "ETF month" representing the culmination of applications filed 12-18 months earlier under traditional review timelines.

However, the September 17, 2025, adoption of generic listing standards fundamentally altered approval mechanics. The new framework eliminates individual 19b-4 exchange rule filings and their 240-day statutory review periods, compressing approval timelines to 60-75 days for S-1 registration statements alone. This procedural innovation means deadlines have become less determinative—the SEC can approve applications "any day" once S-1 amendments receive clearance, rather than being bound by specific dates.

All nine Solana ETF issuers submitted fourth S-1 amendments in late September 2025, incorporating final SEC feedback on fee structures, staking mechanics, and in-kind creation/redemption provisions.

Market implications: Institutional inflows and price trajectory

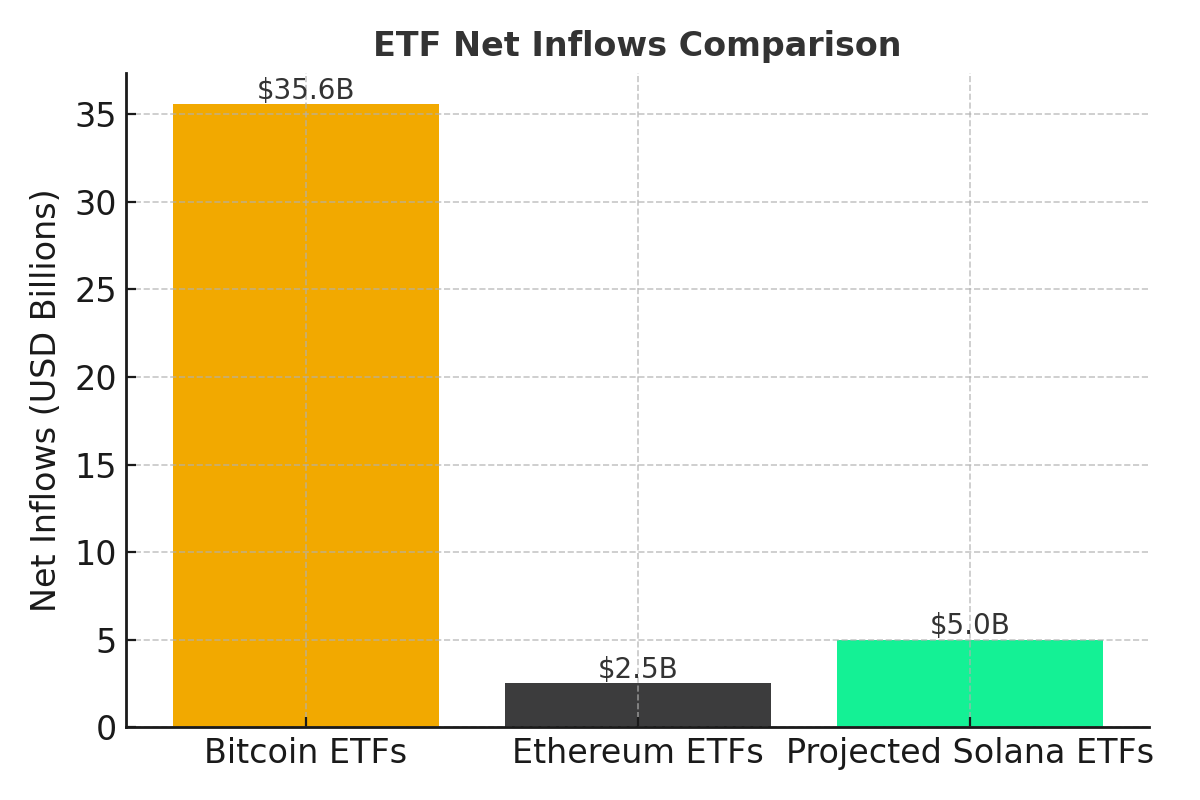

Bitcoin ETF approval on January 10, 2024, provides the closest precedent for predicting Solana ETF market impact. Bitcoin ETFs accumulated $35.6 billion in net inflows within 18 months of launch, becoming the fastest-growing ETF category in history. BlackRock's iShares Bitcoin Trust (IBIT) reached $81-84 billion in assets, becoming the 35th largest U.S. ETF overall and recording the third-highest inflows in 2024 ($37.2 billion) after only VOO and IVV—the massive Vanguard and iShares S&P 500 index funds. Bitcoin's price appreciated from approximately $47,000 at ETF approval to over $109,000 by August 2025—a 144% gain—with Galaxy Digital accurately projecting 74.1% first-year appreciation.

Ethereum ETF performance provides a tempering comparison. While approved July 23, 2024, Ethereum ETFs accumulated only $2.5 billion in net inflows compared to Bitcoin's $35.6 billion—roughly 7% of Bitcoin's total. In August 2025, a temporary rotation occurred, with $4 billion flowing into Ethereum products, while Bitcoin experienced $800 million in outflows. However, the long-term trajectory indicates substantially lower institutional adoption.

Comparing Solana to the altcoin ETF pipeline: XRP, Litecoin, and 14 others

Solana enters the altcoin ETF approval race amid unprecedented filing volume—the October 2025 "ETF month" includes final deadlines for 16+ cryptocurrency ETF applications spanning eight different digital assets. Bloomberg Intelligence assigns 90-100% approval odds to seven altcoins: Litecoin (90%), XRP (95%), Solana (75-100%), Hedera (90%), Avalanche (90%), Dogecoin (80-90%), and Cardano (75-92%), suggesting the first wave of altcoin ETF approvals will be comprehensive rather than selective.

Litecoin is the most likely candidate for initial approval based on its regulatory profile. With a 90% Bloomberg approval probability and October 2-10 deadlines for Canary Capital and Grayscale applications, LTC benefits from never being classified as a security by the SEC, possession of CFTC-regulated futures markets since before the crypto winter, and the longest operational history among applicants (launched in 2011).

Conclusion: Regulatory transformation enables inevitable approval

The convergence of political will, procedural reform, and regulatory leadership change has transformed Solana ETF approval from unlikely to inevitable. While significant obstacles existed under the Gensler SEC—securities classifications in enforcement actions, centralization concerns, staking uncertainties—each barrier has been systematically dismantled through case dismissals, Staff guidance on protocol staking, and generic listing standards adoption. Bloomberg analysts' 100% approval odds reflect not wishful thinking but realistic assessment of fundamentally altered regulatory conditions.

The Bitcoin and Ethereum ETF precedents—$35.6 billion and $2.5 billion in institutional inflows, respectively—demonstrate validated institutional demand for regulated cryptocurrency exposure. Solana's superior technical characteristics (65,000 TPS, sub-penny fees), ecosystem dominance (87% of new 2024 token launches), and $123 billion market capitalization position it as the leading altcoin ETF candidate alongside XRP and Litecoin. VanEck's $520 price target and analyst projections of $3-6 billion in initial inflows suggest a substantial market impact. However, each successive cryptocurrency ETF is likely to capture a smaller market share than its predecessors.

For legal and fintech professionals, the Solana ETF approval process exemplifies the broader maturation of cryptocurrency regulatory frameworks. The evolution from blanket rejection through "regulation by enforcement" to structured approval frameworks signals the digital asset industry's integration into traditional finance. The Trump administration's explicit commitment to crypto leadership, combined with Congressional pressure and state-level lawsuits challenging the SEC overreach, demonstrates crypto's political mainstreaming.