Key Fintech Trends 2025: Venture Capital Strategic Insights

Fintech trends for 2025 reveal a market where venture capital investors and fintech executives are navigating a landscape shaped by technological innovation, evolving regulations, political turmoil, and shifting market dynamics. While many fintech trends from 2024 continue, new dynamics are significantly influencing strategic investments and operational priorities.

This comprehensive analysis explores key fintech trends for 2025, integrating data-driven insights and actionable recommendations for venture capital leaders in the sector.

Fintech Trends 2025

Investment Climate: Cautious Optimism and Strategic Consolidation

2024 was challenging for the global fintech and venture capital market, marking significant investment-level drops.

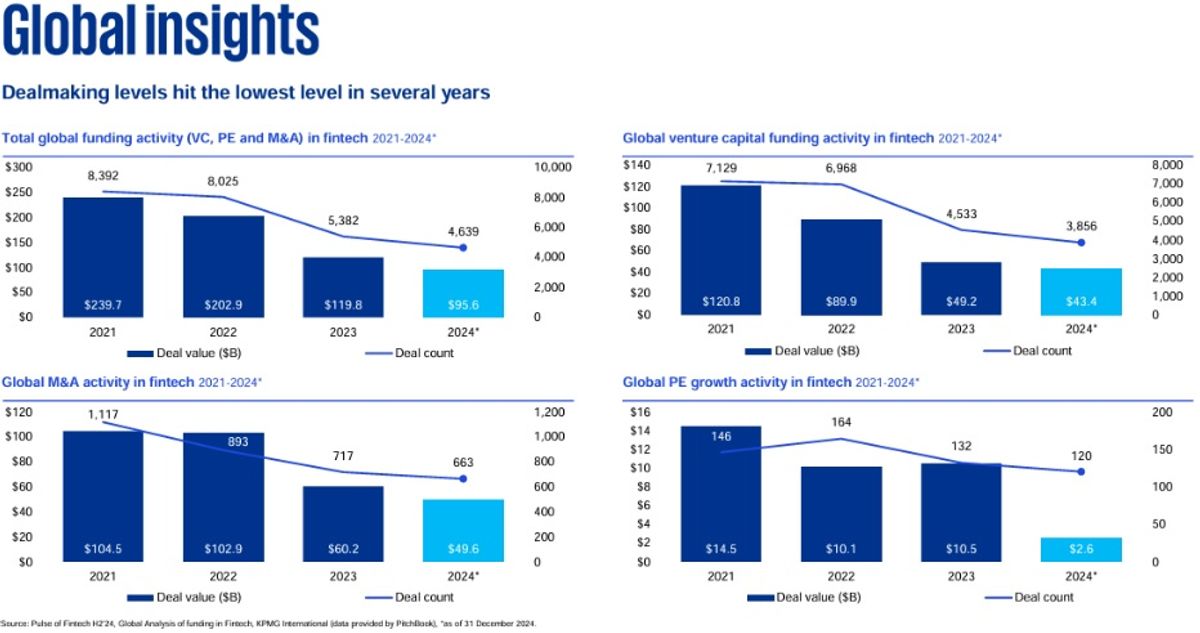

According to KPMG’s Pulse of Fintech H2 2024 report (and as illustrated in their graphs below), global fintech investment and deal volume fell to seven-year lows, totaling $95.6 billion across 4,639 deals.

This was driven by macroeconomic uncertainties, geopolitical tensions, and major elections. Specifically, global investment declined from $51.7 billion in H1 2024 to $43.9 billion in H2 2024.

Despite this, there was a notable recovery in Q4 of 2024, as mergers and acquisitions (M&A) deal value nearly doubled from $7.4 billion to $14.2 billion, and venture capital (VC) investment rose from $9.7 billion to $11.2 billion quarter-over-quarter (KPMG Pulse of Fintech).

Figure 1: Global Fintech Funding Activity (VC, PE, and M&A) 2021-2024. Source: KPMG Pulse of Fintech H2’24 report, data provided by PitchBook, December 31, 2024. Available at: kpmg.com/fintechpulse.

The Americas dominated fintech investment, attracting $31 billion in H2 2024 and hosting the only $1 billion+ deals globally.

Major transactions included Nuvei ($6.3 billion), Envestnet ($4.5 billion), and Candescent ($2.45 billion).

In contrast, Europe, the Middle East, and Africa (EMEA) secured $7.3 billion, highlighted by the acquisition of Netherlands-based Knab Bank ($561 million), indicating fewer mega-deals and reflecting cautious investor sentiment.

Asia-Pacific (APAC) attracted $5.5 billion, with significant deals such as a $788 million funding round for Philippines-based Mynt.

Payments remained the leading fintech subsector globally, securing $31 billion, followed by digital assets ($9.1 billion) and regtech ($7.4 billion).

Fintech Trends 2025

Technological Evolution:

AI-Driven Innovation Accelerates

Artificial Intelligence (AI) remains pivotal, driving fintech innovation beyond traditional roles such as fraud detection.

AI now powers advanced predictive analytics, automated decision-making, and complex risk management models.

MarketWatch (2025) highlights substantial AI investment, with firms such as Visa allocating over $10 billion to technology development in the past decade, with $3 billion to AI infrastructure (MarketWatch).

Much of this spending is going toward antifraud and cybersecurity development, but not all of it.

Fintech firms increasingly use AI for hyper-personalization, significantly enhancing customer engagement and loyalty—key metrics driving valuation and competitive advantage.

Opportunities exist for fintech startups to focus on customer interactions to help drive satisfaction and scalability.

The development of these technologies will likely lead to an AI-onshoring trend as companies use technology to engage with customers instead of low-cost, overseas call centers.

Regulatory Landscape: Expanding Open Banking and Compliance Requirements

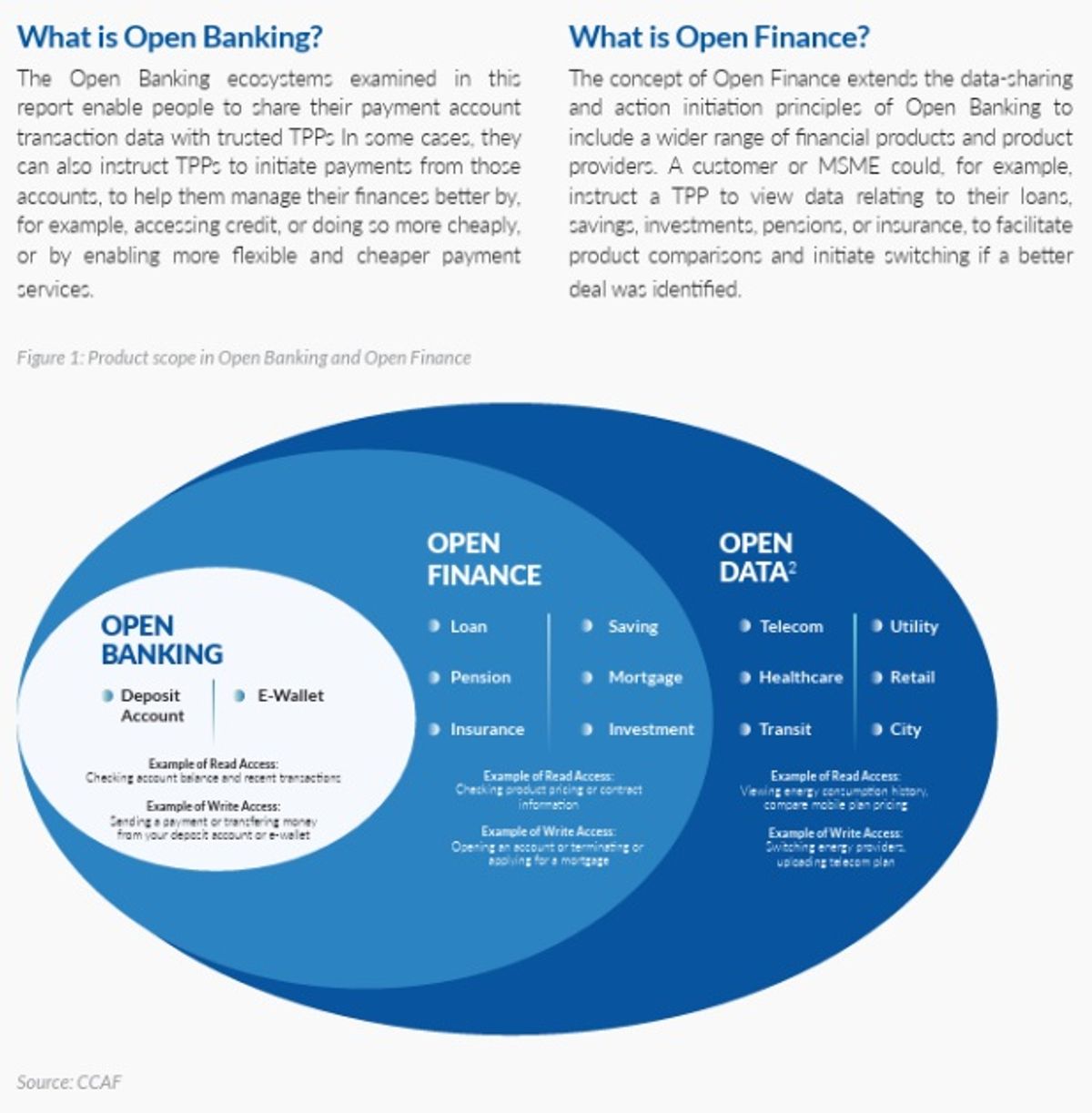

While AI dominates headlines, fintech continues to progress in other areas. Open banking regulations have become firmly established globally.

Over 60 jurisdictions have adopted comprehensive frameworks, significantly transforming the fintech landscape (Cambridge Centre for Alternative Finance, 2025).

In the U.S., Consumer Financial Protection Bureau regulations have notably strengthened bank-fintech partnerships, enhancing competition and fostering innovation (Reuters).

Figure 2: CCAF (2024), The Global State of Open Banking and Open Finance, Cambridge: Cambridge Centre for Alternative Finance, Cambridge Judge Business School, University of Cambridge, p. 13.

Additionally, heightened compliance demands around data security and financial reporting, notably enhanced Form PF requirements by the U.S. Securities and Exchange Commission (SEC), which require increased data reporting by private fund managers, are driving growth in regulatory technology (RegTech), creating opportunities for fintech firms specializing in compliance solutions.

However, the challenge with RegTech is that the overall B2B market size for products remains relatively small compared to consumer-oriented products, and many market participants are small or mid-sized businesses that are price-sensitive.

Fintech Trends 2025

Adjustments in Venture Capital and Private Equity

Venture capital continues cautiously, targeting fintech startups with clear profitability paths and operational scalability.

Despite lower overall volumes, strategic investments persist in high-value areas such as AI, regulatory technology, and digital payments.

However, the venture capital market has undergone a systemic change over the past decade, as more and more successful startups struggle to find a path to an initial public offering or other exit that rewards investors, including late-stage investors who often participate at high valuations.

Overall, most venture capital investors have to wait longer to see a return on investment, and those that do often see it as a secondary market transaction (i.e., a resale of private securities in private markets).

According to Bloomberg (2025), “[a]n estimated $122 billion in assets are expected to change hands in the secondary market in 2025, up from $25 billion in 2012.” (Why the Venture Capital Secondary Market Is So Hot Right Now.)

Figure 3: Why the Venture Capital Secondary Market is So Hot Right Now, Bloomberg, citing The Secondary Market is Booming, Industry Ventures

These secondary transactions come with heightened risks, especially compared to public secondary transactions.

For one, private investors have less access to the portfolio company’s financial and performance information, and approval by managers or general partners to private funds is often required to complete a transaction, which is not automatic. This lack of information can create valuation issues.

Additionally, asset verification is an issue, especially if the private securities are those of a special-purpose vehicle (SPV) or other pooled investment vehicle (PIV) that has not invested directly with the underlying portfolio company. This layering of secondary transactions can make it challenging to prove who owns what.

Private equity remains robust, especially in tech-driven fintech acquisitions. Strategic alignment in valuation expectations facilitates active deal-making, enhancing sector growth.

However, like venture capital markets, PE markets have seen a rise in secondary transactions, especially manager- or GP-led secondary transactions.

While asset verification is less of an issue in PE markets, which don’t have as many layers as the VC space, valuation is still a potential risk. In manager- and GP-led transactions, there is an inherent conflict of interest for the manager/GP to maximize the asset price to juice the returns of the initial fund at the expense of the continuation fund.

Regulators are paying more attention to these transactions to ensure that later investors receive a fair price for their subscriptions.

Realistic valuations persist, with fintech firms emphasizing robust liquidity management strategies to mitigate risks associated with extended holding periods and reliance on Net Asset Value (NAV) lending. Solutions providing improved valuation transparency and innovative liquidity management tools remain attractive to investors.

Fintech Trends 2025

The Rise of Private Credit

Private credit continues to experience strong growth, driven by investor demand for yield amid fluctuating interest rates and market volatility.

These strategies encompass direct lending, mezzanine debt, distressed debt, and special situations, and are used by many borrowers as substitutes for traditional loans.

Institutional investors have significantly increased allocations to private credit strategies, presenting opportunities for fintech platforms focused on enhancing lending efficiency, risk management, and asset management.

According to the Bank of International Settlements (BIS), global private credit assets under management (AUM) have grown from $0.2 billion to $2,500 billion in the past two decades, while the volume of loans has increased from $100 billion to over $1.2 trillion; 87% of these loans originate in the U.S. (The global drivers of private credit.)

The BIS found that private credit is most popular in countries with low interest rates, a falling cost of equity, and increased leverage of business development companies (BDCs), all of which describe the United States to a “t.”

As funding costs decline, the attractiveness of private credit as an alternative to traditional banks increases. According to Deloitte (2024), private credit has replaced the traditional syndicate loan market for leveraged buyouts (Deloitte: How a Credit Surge is Reshaping Corporate Lending | FinTech Magazine), including buyouts of fintech.

Fintech Trends 2025

Regional Fintech Trends & Growth: Latin America and Asia-Pacific

Latin America, particularly Mexico and Brazil, continues robust fintech growth driven by digital adoption and venture capital investment.

Notable examples include Mexico’s Clara, which achieved unicorn status, exceeding $1 billion (Financial Times), and Brazil’s Nubank, maintaining its position as a leading global digital bank (CB Insights).

The Asia-Pacific region also thrives, with India surpassing 87 billion digital payment transactions in 2024, Indonesia attracting $1.5 billion in fintech investments, and Vietnam experiencing a 35% investment growth year-over-year (Tech in Asia).

Strategic Recommendations for Venture Capital Leaders in 2025

To effectively navigate the evolving fintech landscape, fintech executives and venture capital investors should:

- Accelerate AI Implementation

Prioritize investments in advanced AI for predictive analytics and personalization. - Enhance RegTech Capabilities

Invest in or partner with robust regulatory technology providers for streamlined compliance management. - Capitalize on Private Credit Market Growth

Focus fintech innovations on lending efficiency, risk management, and asset management strategies. - Strengthen Valuation and Liquidity Management Practices

Implement transparent valuation methodologies and proactive liquidity management solutions.

Fintech Trends 2025

Final Thoughts

In 2025, fintech trends continue to evolve through strategic investments, technological advancements, regulatory developments, and market-driven adaptations.

Leaders who proactively engage with these fintech trends will secure competitive advantages, sustainability, and long-term sector leadership.

Ready to capitalize on these fintech trends?